This remortgage guide is broken into two parts. First, the short answer which will quickly help you decide whether to fix your mortgage, how long to fix for and how to secure you the best fixed-rate mortgage deal. The longer answer will explain in detail:

This remortgage guide is broken into two parts. First, the short answer which will quickly help you decide whether to fix your mortgage, how long to fix for and how to secure you the best fixed-rate mortgage deal. The longer answer will explain in detail:

- Why you might consider fixing your mortgage now

- How far they will fall

- How long you should fix your mortgage for (2, 3, 5 or 10 years)

- How to find the best fixed-rate mortgage deal

The short answer: interest rates and remortgaging

According to the Bank of England (BoE), the annual rate of inflation peaked at the end of 2022, driven mainly by energy and food price rises. It has since fallen back to towards the BoE's target inflation rate of 2%. When inflation is significantly above the BoE's target rate then it may look to raise interest rates to try and bring inflation back under control. The Bank of England started increasing interest rates back in December 2021, with the last rise being in August 2023 when the base rate went up from 5% to 5.25%, the highest level since 2008. When the BoE base rate increases, fixed-rate mortgage deals also tend to increase.

However, satisfied that inflation was finally under control, the Bank of England announced its first rate cut for more than four years on the 1st August 2024, when it voted to cut the base rate from 5.25% to 5%. The BoE cut the base rate again on 7th of November 2024, to its current level of 4.75%. When the BoE base rate is cut and the market anticipates further rate cuts then the rates on fixed-rate mortgages tend to fall as well.

However, the latest official UK inflation rate unexpectedly leapt higher to 2.3% in October, back above the BoE target. In addition, following the Labour government's Autumn Budget in October 2024 the market now anticipates that the proposed tax rises and spending plans will push inflation higher, something that the Bank of England has concurred with. Of course, if inflation starts to pick up significantly then interest rates could begin to rise once again.

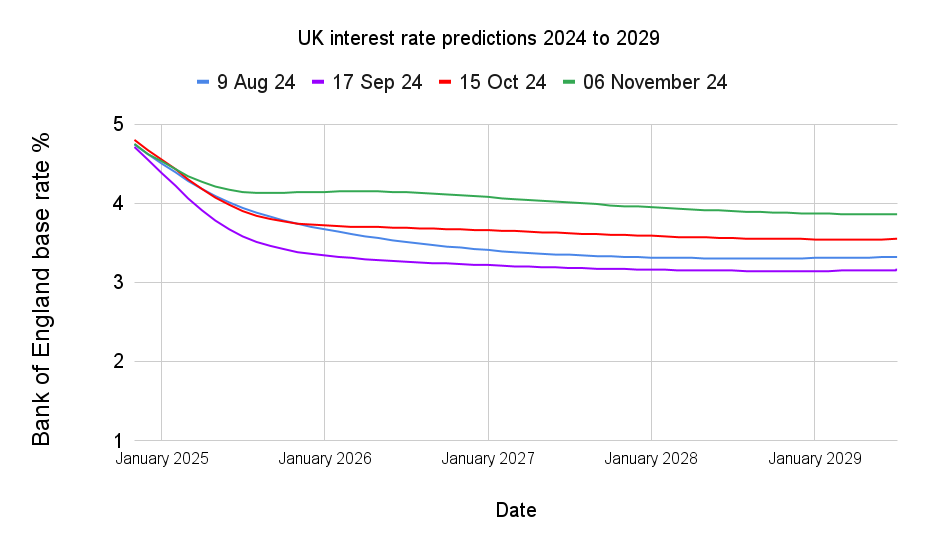

However, while the market is now predicting that a base rate cut in December 2024 is less likely it is still predicting that the base rate will continue to fall gradually over the next five years, to 4.14% by January 2026 and to 3.87% by January 2029. These predictions are markedly higher than the predictions made prior to the latest inflation data and the Autumn Budget. As such, mortgage lenders have pulled products and started raising the interest rates on their fixed-rate mortgage products.

If you are worried about that your monthly mortgage payments could rise in the future, then fixing your mortgage rate remains a sensible choice. It means that it is important to shop around to find the best fixed-rate mortage deal as rates could remain elevated for some time. However, while tracker mortgages and offset mortgages have increased in popularity, as mortgage rates fell during the summer, the best tracker mortgage rates are still higher than the equivalent best rates on fixed-rate mortgages. In addition, the market is now predicting that interest rates will not fall as quickly as previously hoped and that they will stay higher for longer. It is therefore important to consider all of your options and the costs when reviewing your mortgage. I explain one of the best ways to do this in the section titled "Get a free mortgage review now".

Is your fixed rate deal coming to an end?

A free mortgage review will tell you the best option even if that's staying with your existing lender - No obligation

Remortgaging an existing fixed-rate mortgage

If you have a fixed-rate mortgage then your mortgage repayments won't change as a result of interest-rate changes by the Bank of England (BoE). During the initial introductory period, you are guaranteed to pay the same amount every month, which means you won't benefit from rate cuts but also won't be hit if interest rates rise.

With a fixed-rate mortgage it's a good idea to check when your deal runs out and if there is an early repayment charge if you end the deal before the fixed term comes to an end. If you can get a new mortgage deal at a substantially lower rate than you are currently paying, you may be able to save money by switching, particularly if there are low - or no - early repayment charges. However, in the current environment you are likely to pay a higher interest rate when you remortgage than on your existing deal, if you took it out before 2022, because of the BoE base rate rises.

But remember, if your fixed-rate deal is due to finish in the next six months it is possible to arrange a new mortgage deal that will start when your existing fixed deal comes to an end. That way you can lock in a new rate now, in case mortgage rates rise further in the coming months, and avoid paying an early repayment charge at the same time. But even if mortgage rates continue to fall before your new deal starts it is possible to change the new deal, although you may incur some costs to do so.

For more information on fixed-rate mortgages, check out our article "What is a fixed-rate mortgage? Everything you need to know".

Also, it is also worth pointing out that if you are worried about passing a new lender's affordability tests (perhaps your income has dropped since you took out your existing mortgage) you can just switch to a new deal with your existing lender (called a product transfer) without the need for such checks. However, it means you are unlikely to secure the best deal in the market unless it happens to be with your existing lender.

Remortgaging an existing tracker mortgage

As a tracker mortgage typically goes up and down in line with the BoE base rate, borrowers with this type of deal benefitted from the interest-rate cuts in 2020 but were hurt by the rises between 2021 and 2023. However, the decision now on whether to remortgage will largely be determined by what you think is going to happen to interest rates in the future. If you believe rates are going to fall, it makes sense to consider remortgaging onto a new tracker mortgage if your existing deal is due to revert to your lender's higher standard variable rate. If, however, you anticipate (or are worried that) rates could go back up, then it could pay to fix now while you can still get a competitive fixed-rate deal. Our article "What is a tracker mortgage and is it right for you?" has more details on tracker mortgages. One other thing to bear in mind is that at the moment, tracker mortgage rates start significantly higher than the equivalent rates on fixed-rate mortgages.

Will interest rates go up again or start to fall?

The Bank of England raised its base rate 14 times between December 2021 and August 2023, to a high of 5.25%. In August 2024 and November 2024 it decided to cut interest rates, meaning the Bank of England base rate now sits at 4.75%.

However, the market is now predicting that interest rates will remain higher and for longer than previously predicted. Investment markets are predicting the Bank of England won't next cut rates again until February 2025 and then by just 0.25%, as shown by the green line in the chart below. The other coloured lines show the market predictions made in recent months. For example, the blue line was the prediction made on the 9th August 2024. Notice how the market has raised where it now thinks the base rate will be in the future (the green line) compared to the prediction made in October 2024 (the red line) just before the Autumn Budget.

Historically the norm for the base rate has been around the 5% mark. For the latest view on when interest rates might rise or fall, read the latest interest rate predictions. The article is continually updated and reveals when the market predicts interest rates will rise, how high they will go and when they will come back down.

Get a free mortgage review now

Whichever type of mortgage you are on, it is a good time to review your mortgage and the options available to you. The simplest trouble-free route, which I'd recommend, is to seek the help of a mortgage adviser. If you don't know a mortgage adviser whose opinion you trust then there are two ways to find a reputable one:

1) Use a leading online mortgage broker

You can have your mortgage reviewed for free online through Habito*, one of the first online mortgage brokers in the UK. I've personally been into Habito's* offices to grill them over their proposition and recommendation process and was impressed. Habito will check through over 20,000 mortgages from more than 90 mortgage lenders for you before making a recommendation. That recommendation may even be that your existing lender offers the best deal and you should stay where you are. They will also help you decide whether a new fixed-rate mortgage is right for you.

The whole process can be carried out online (without the need for face-to-face meetings). Habito has a 4.9 (out of 5) star rating on Trustpilot from over 9,000 customer reviews. It only takes 10-15 mins to register online and Habito will be able to give you instant, free mortgage advice.

To get started:

- Click the link - Habito mortgage review* and then click 'Get started'

- Create your account either by entering your email address and setting up a secure password or by linking your Facebook or Google account

- Enter your details

- Once completed you will be put in touch with your own personal mortgage specialist who will guide you through the process from start to finish

2) Get a mortgage review using an offline specialist

Alternatively, you can request a free mortgage review* from a vetted FCA-regulated mortgage professional. It is the more traditional (offline) route but we check the experience consumers receive to ensure that it is of the best quality, with no obligation on their part and that the savings are genuine. To get started:

- Click the link free mortgage review*

- Answer the brief questions about your situation

- Enter your contact details

Get a FREE mortgage review

Our partner Vouchedfor will help you get the best mortgage rate with a free mortgage review

- From a 5-star rated mortgage adviser

- Typically save £80 per month per £100,000 of your mortgage

- No obligation

The long answer: should I fix my mortgage?

Why fix your mortgage rate?

At the heart of the ‘should you fix your mortgage’ question is a worry that interest rates will head higher. The attraction of fixing your mortgage rate is the certainty it brings to your monthly mortgage repayments. The interest rate on a fixed-rate mortgage is fixed for a specific period of time and will remain at this rate regardless of changes to the interest rate in the marketplace. Once the fixed period expires then the rate will normally convert to the lender's standard variable rate (SVR), or another fixed rate if available. Lenders frequently charge a fee - early repayment charge - if a borrower wishes to terminate or switch to another deal within the fixed term.

People who are currently paying their lender’s SVR are vulnerable to interest rate rises. If interest rates go up then so will their monthly mortgage payments. Similarly, tracker and variable rate mortgages have interest rates which reference the Bank of England base rate, currently at 4.75%. However, while tracker mortgages will move in step with the base rate lenders can often move their standard variable rates with no defined link to the base rate.

So, if you are on the lender’s default SVR, then check the terms and conditions. Some lenders have SVRs which will always be at least 2-3% above the BoE base rate.

Is now the best time to fix your mortgage?

As interest rates rise, as they have done over the last few years, there is increased demand for fixed-rate deals as buyers and those remortgaging want to secure a competitive rate. The trouble is that mortgage lenders will have limited availability on each mortgage deal. When they hit their target they will no longer accept any new borrowers. This has a knock-on effect on other lenders and the rates on even the cheapest fixed-rate mortgage will rise. So when consumers inevitably all rush to fix their mortgages as lenders introduce new and improved rates then all the best deals will quickly evaporate. If you are contemplating fixing your mortgage rate, it's prudent to take action now rather than later, especially given that interest rates on fixed-rate mortgage deals have begun rising once again. Don't forget, if you secure a fixed-rate deal, which is ready to start when your existing fixed-rate deal ends, it is possible to change the new deal if mortgage rates drop in the meantime. I explain this in more detail in the section below titled "One trick to keep your mortgage options open".

How long should I fix my mortgage for - 2, 3, 5, 10 years - or longer?

If you have a low loan-to-value (the size of your mortgage as a percentage of your property value) then you could benefit from fixing, as you will be able to secure a lower fixed-interest rate than someone with a higher loan-to-value.

The longer your fixed term, the longer you are locked into an interest rate. Although there is no limit to how many times you can remortgage if you opt for a long fixed-term period you may have exit penalties and early redemption fees if you want to repay your mortgage or move (unless you have a portability option) or borrow more money. In addition, if the BoE base rate is cut further, you won't benefit either. These factors have to be traded off against the cost of exiting your current deal (which forms part of the overall cost of remortgaging) and the certainty that a fixed-term mortgage provides.

A recent development in the market has been the introduction of longer-term fixed-rate mortgage deals with terms of up to 40 years. The longest you can currently get is a 25-year fixed-rate mortgage from Kensington Mortgages. These longer-term deals attract a higher interest rate, but give certainty over the amount you will have to pay over the long term. It also removes the cost and effort of having to remortgage every few years. There are more details in our article "Which are the best long-term fixed rates mortgages - and should you get one?"

2-year vs 5-year fixed-rate mortgage deals

When it comes to remortgaging, those that are keen to fix will likely find themselves choosing between a 2 or 5-year fixed-rate mortgage deal. At the time of writing, the best 2-year fixed-rate mortgage with a 60% loan-to-value is 4.11%, while the best 5-year fixed-rate mortgage with a 60% loan-to-value is currently around 4%. That means that it is currently more expensive to lock in a 2 year fixed-rate deal and this is because of the future expectations on where the Bank of England base rate is likely to be over the next five years. You can see the latest interest rate predictions in our image above.

To work out whether a 2-year or 5-year fixed-rate deal is best, you will need to consider all of the following:

- The latest interest rate predictions - While they are only predictions, it is worth considering where rates are likely to be over the coming years and how rate rises (or cuts) would impact your ability to repay your mortgage. Bear in mind that the market nearly always gets its predictions wrong!

- Affordability - Think about your income and outgoings and how these are likely to change in the coming years. Can you afford to remortgage at the current rate and could you afford to pay a higher rate if rates rise in the future?

- Desire for certainty - Are you more concerned about long-term certainty of what your mortgage payments will be? If so a longer-term fix will be more attractive.

- Future intentions - Are you likely to need to move in the coming years and could you port the mortgage you may have at that time? Are you planning on having children or will you need to move areas for work or to be closer to a particular school?

Those that think that rates may continue to come down might opt for a 2-year fix in the hope that they can remortgage to a better rate in two years' time. Of course, there is the risk that rates do not come down and could, in fact, be higher in two years' time.

Those keen to have the security of knowing how much their mortgage will be each month may prefer to opt for a 5-year fixed-rate deal. A lot can happen in 5 years, however, so think carefully about your family setup and also how you would feel if interest rates are suddenly cut. A key consideration when choosing a longer fixed-rate deal is the early repayment charges that may apply. An early repayment charge (ERC) is a fee applied by your mortgage lender if you change the terms of your mortgage or repay it before the end of your agreed fixed period. Early repayment charges on a 5-year fixed-rate mortgage can be as high as 5% of the outstanding balance in year 1, often reducing to 4% in year 2, down to 1% in the final year. Two year fixed-rate deals often have ERCs that start at 2% before falling over the course of the fixed period. So if for example, you plan to move home in the next few years, a long term fixed-rate deal may not be as attractive.

So when is it worth remortgaging?

If your SVR is low (say around 4-5% which is unlikely given the average is 8%) and you have little or no equity in your property, you may be better off sticking with your existing deal for the time being. In some cases you won’t have a choice if your LTV is too high or you are in negative equity. But even those people may be able to switch to a cheaper mortgage rate with their existing lender, known as a product transfer.

Should I get a variable or fixed-rate mortgage?

While I've highlighted the pros and cons of fixing your mortgage the alternative is to deliberately choose a variable rate mortgage. With a fixed-rate mortgage your interest rate is fixed for, say, 2 years and when your fixed-rate period ends you move on to the lender's higher SVR. If you took out a variable rate mortgage, rather than a fixed-rate mortgage, then the interest rate would initially rise and fall in relation to the BoE base rate (i.e. a tracker mortgage) for say 2 years and then at the whim of the lender for the rest of the life of the mortgage or until you remortgage. However, currently you will pay a higher initial rate on a tracker mortgage than the equivalent fixed-rate mortgage. Although you may benefit from a lower mortgage rate if you choose a discounted mortgage, depending on the individual deal. However, if the BoE base rate is cut further the monthly repayments on a variable rate mortgage will usually fall too.

How to find the best fixed-rate mortgage

Most consumers will wrongly assume that using a price comparison site is the best thing to do when looking to remortgage. However, bear in mind:

- many mortgage deals are only available via mortgage advisers so don't appear on price comparison sites

- not everyone can get the rates quoted on price comparison sites

- price comparison sites don't take into account your credit rating or personal circumstances which will determine whether a lender will actually lend to you. For example, you may not be eligible for the deals quoted by comparison sites and won't find out until they credit check you. That in itself will then hinder future mortgage applications

- there may be options open to you other than fixing your mortgage, such as a capped mortgage.

That is why you are almost always better off seeking advice from an independent mortgage adviser rather than going it alone. Which is why most borrowers now use a mortgage adviser to find the best deal from a lender who will actually lend to them.

I therefore recommend that you arrange a free mortgage review* by an FCA-regulated mortgage adviser. Simply click on the link and answer the few questions about your situation and a regulated mortgage adviser will get in touch and inform you if it is possible for you to remortgage and how much you can save.

How to research the best mortgage deals yourself

Alternatively, if you do want to go it alone the first thing you need to work out is what fixed-rate you will get. This will depend on, among other things, the amount you want to borrow compared to the value of your property (LTV), your credit rating, your earnings and the type of mortgage you want.

A good starting point is our mortgage calculator, powered by Habito. This can give you an idea of the best and cheapest deals you may be eligible for.

One trick to keep your mortgage options open

If you want to fix your mortgage rate (or remortgage on to a new fixed deal) but are unsure whether to do it now or later, you could hedge your bets by getting a mortgage offer in place now and not completing for, say, 6 months. That way you have a good fixed-rate deal ready to go and can still take advantage of your current low rate for a few more months. Obviously, you must bear in mind that you will likely incur non-refundable valuation charges, whether or not you actually decide to complete in the end, and the lender could technically withdraw their offer before you accept. But these are risks that you would face even if you fixed now. The other benefit is that if a better deal becomes available while you are waiting for your new deal to start you could technically decide to cancel that and remortgage elsewhere at a cheaper rate, but you will likely incur the aforementioned charges from the previously secured lender and possibly your mortgage broker plus you'd likely require new credit checks.

If a link has an * beside it this means that it is an affiliated link. If you go via the link, Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - Habito, Vouchedfor,

Great insights in this post! With the rising interest rates, it’s definitely worth considering a fixed-rate remortgage. I appreciate the breakdown of different timeframes; it really helps in deciding whether to go for a short or long-term fix. Looking forward to seeing how the market evolves in 2024!

Hi, I’m glad you found it useful.

Damien

Great article, really helpful advice.

Thanks

Hi I would like to talk to someone about my mortgage options, I am fixed until April next year so I may be abit early to be worrying about rates going up then however I do not know much about mortgages.

Hi,

The best thing to do is to arrange a free mortgage review from an FCA-regulated mortgage adviser. You can do this by clicking on the link in the article under the section titled ‘Get a mortgage review using an offline specialist’.

hi there. great set of articles on path of short term interest rates.

wondering however, you have a graph titled as follows;

‘How high will interest rates go? Here’s what the market is pricing in’

where does this market information come from please? is this a poll of economists or are there financial instruments that are suggesting or predicting the likely future interest rate path?

your help would be appreicated.

It is based upon overnight index swaps published by the Bank of England. Or in other words, it’s based on data showing where financial institutions are pricing where interest rates might be in the future.

I have a fix (2.60) ending in September 2023. Is it worth coming out of fixed term now (penalty around £1500) and fixing for another two years with same provider at a higher rate? There’ll also be a fee of £999 to pay. Mad or prudent?

Hi Bridget,

Here is a repayment calculator that will help you decide whether paying an early repayment charge (ERC) now makes financial sense. It works by comparing paying the ERC and moving onto the new deal now against waiting until your current deal is due to expire (when there would be no ERC) and securing a new fixed mortgage rate then based on where the market predicts interest rates are going.

But before you do anything make sure you speak to a mortgage adviser – if you don’t have one already you can trust then you can request a mortgage review via the link in the article above.

Looking at the graph showing the predicted BoE interest rates I do not understand why in July 2023 when the BoE rate is anticipated to be 5.5% it is suggested that 2 year fixed rates could be as high as 6.5%. Assuming the interest rate predictions are correct (not guaranteed I know but lets assume they are for this purpose of this) the market would be pricing in declining rates from July 2023, therefore surely a 2 year fixed rate is likely to be less than the suggested 6.5%

Hi Robert,

Fixed rate mortgage rates are based upon the funding that mortgage lenders can secure. This can be via government schemes or through the open market. However it is very hard to gain visibility on what these rates could be in the future. Factors that will influence this include the Bank of England base rate and gilt yields.

The above chart takes all of this into account by looking at the swap rates in the market – which provide a pretty accurate picture of where the base rate is predicted to be in the future. Typically the best fixed mortgage rates are at least 1% higher than the base rate. That’s not set in stone but has often proved a good benchmark in the past.

If the market began predicting rates would tumble in the future, then conceivably yes you could get long term fixed rate deals that are lower than the “predicted base rate + 1%” estimate. But just as equally the opposite could be true too. So it remains a good benchmark.

Best wishes

Damien

Really helpful and coherent advice.

Much appreciated,

Aidan

I’m on a tracker mortgage (no early repayment fees) and I have managed to get it down to less than £40,000 through overpayments. My question is, if I have the funds, should I just pay it off? I know the advice used to be that if mortgage rates are higher than savings interest rates, then maybe you should. But what are the other pros and cons? I am single, aged 50 and retired (due to ill health). Is it worth staying on the mortgage ladder or not? Thanks

Hi,

Here is an article which you will find useful – How to pay off your mortgage faster – and is it a good idea?.

Hi Damien,

Excellent website and very helpful information and links provided.

I need your expert advice though. My current fixed mortgage is ending 1st Oct 2022. and i have been trying to get a 2 year fixed (As am more likely to sell the current property in a couple of years) . Am getting a tracker mortgage for 2.59 % and a 2 year fixed for 3.2 – 3.44 %. Which one do you suggest i take ?

Thanks & Regards

Rafi M

Hi Rafi,

I can’t tell you which to take out, as it depends on your own circumstances (whether you decide to move or not, your finances etc) and what your view is on future interest rates and whether you want certainty or not. If you want certainty that your mortgage repayments won’t rise then a fixed mortgage will give you that but you will pay more initially. If you want greater flexibility (i.e. you might move in a few months) then a tracker gives you greater flexibility – as fixed mortgages have early repayment charges during the fixed period – but your monthly mortgage repayments are at the whim of interest rate moves with a tracker.

You can see the market’s latest interest rate predictionshere. But remember – markets don’t have a great track record of predicting the future.

Also compare all the costs involved and not just the monthly repayments. Just remember, that whatever decision you make it is made with the best information available to you at the time. Hindsight is always a wonderful thing but not very helpful.

Best wishes

Damien

Fantastic article, and very timely. I’ve used both free advice options to choose the best one!