*Cleo has announced that it is temporarily taking a break from the UK to focus on the app in the US. This means that you are no longer able to download Cleo from the App Store or Google Play store. If you are an existing Cleo customer you will still be able to access the previously downloaded app on your phone but you will not receive any new updates.

If you regularly use Cleo in the UK you will still be able to access Cleo's basic features such as chat, budget and roast mode as support is only being paused for Cleo Plus and Cleo Wallet. Subscription renewals to Cleo Plus were stopped on 19th January 2022, meaning Cleo Plus customers are no longer able to deposit money, create a new Wallet or use the savings features connected to Cleo Wallet (including signing up for a new Cleo Plus subscription).

If you have money in your Cleo Wallet this can be withdrawn by typing 'Withdraw £(full balance amount)' into the chat feature. Cleo says this money needs to be withdrawn within 30 days but you will be emailed with reminders and help if you miss the cut off date.

Cleo says it is planning to re-launch in the UK again within the next 12 months but more information on Cleo pausing UK accounts can be found here.

What is Cleo?

Cleo or as it is sometimes known, meetcleo, is a chatbot that uses artificial intelligence to try to make managing your finances fun.

Launched in 2016, it was founded by former Wonga data scientist Barnaby Hussey-Yeo and has received financial backing from well-known venture capitalists including Index Ventures, Balderton Capital, Octopus Investments, and Y Combinator.

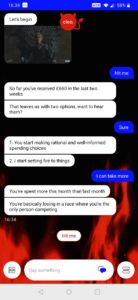

The chatbot or digital assistant links with your bank account to track your spending, manage your budget and recommend how much you can afford to save. It will even play games and get involved in friendly and sometimes not so friendly banter with you. She, as the chatbot is referred to, has 2.6m users worldwide. So is it time you made friends with Cleo?

Cleo features

- Track your spending - easily see where your money goes each month with spending categorisation

- Set a budget - set a spending budget for trips away or nights out and get notified if you are nearing your limit.

- Save money automatically - Cleo's algorithm can detect how much you can afford to save and move the money into an e-money account automatically

- Set goals - Create and set multiple goals within Cleo to encourage you to reach your savings targets.

- Cleo+ - You can get extras such as cashback or a salary advance of up to £100 as part of Cleo’s subscription service.

- Chat - Use the chat function to be 'roasted' or 'hyped' on your spending habits

How does Cleo work?

You can get chatting with Cleo by downloading its smartphone app. The process takes two minutes to set up once you have entered your details and selected and linked your bank account. Not all banks are available but you can request to add providers if yours isn’t available. Find out which banks Cleo supports here.

The app displays your chosen accounts transactions and categorises your spending and you can then set your budget or start saving within the app by simply using phrases in the chatbox such as “budget” or “save.”

The more it gets to know your spending patterns, the better Cleo’s algorithm and recommendation will be.

Which banks does Cleo support?

Currently, Cleo supports the following banks in the UK. If yours isn't on the list you can request for your bank to be added. Cleo says Monzo and Starling Bank support is coming soon.

- American Express

- Bank of Scotland

- Barclays

- Capital One

- First Direct

- Halifax

- HSBC

- Lloyds Bank

- Metro Bank

- Nationwide

- NatWest

- Royal Bank of Scotland

- Santander

- TSB Bank

How much does Cleo cost?

Cleo is free to use and set up. The tracking, budgeting and spending analysis are all free as is the saving facility.

You only have to pay if you want to use the Cleo+ service, which includes the salary advance and cashback offers. This costs £5.99 a month.

We compare the different costs and features between Cleo and Cleo+ in the below comparison table.

Cleo account cost comparison

| Cleo | Cleo+ | |

| Monthly Cost | FREE | £5.99 |

| Automatic Saving | ||

| Set goals | ||

| Budgeting | ||

| Salary advance | ||

| Cashback | ||

| Credit score coaching |

Cleo+

Cleo Plus is a £5.99 subscription service that means you have access to more saving features such as salary advance and cashback in addition to the automatic saving with a regular Cleo account. Salary advance is Cleo's answer to 'extortionate overdraft fees' as each payday it gives you a no-interest payment of up to £100 to help you stay out of your overdraft. You can then pay this amount back to Cleo within 28 days. Cleo's salary advance is designed to prevent you from using your overdraft and paying hefty fees. It says that using the Salary advance service does not affect your credit score.

Daily Cash is another feature with the Cleo Plus subscription and allows you to earn cashback on your spending. Daily Cash allows you to earn cashback in 3 different ways; via Money Makers, click throughs and Cleo challenges. To earn cashback via MoneyMakers you can choose 5 places you shop regularly such as Co-op and Uber and earn instant cashback to your Cleo wallet each time you spend using one of these retailers. You can earn up to 7% cashback via click through links to retailer's websites on the Daily Cash page and finally earn additional cash by completing Cleo's challenges, such as talking to Cleo every day for a month.

Cleo Plus also has the option to show you your credit score and notify you when it changes if you live in the US however Cleo says it is hoping to introduce this in the UK in the near future. Find out how you can check your credit report for free here.

Is Cleo safe to use?

Cleo describes its systems as 'ridiculously safe'. It uses bank-level encryption and never saves any of your information. Your account is connected in read-only mode so it can only see the numbers and can’t access or move money without your permission.

It is regulated by the Financial Conduct Authority for the payment services it provides such as moving money around but there is no Financial Services Compensation Scheme protection. Cleo does, however, promise to protect up to £85,000 of losses if money is lost as a result of signing up or the use of its platform.

Cleo customer reviews

Cleo only launched in 2016 but already has a strong following and plenty of reviews. More than 1,700 users have left reviews in the UK on Trustpilot, with an average score of 3.7 out of 5.0 stars.

The majority, 82%, rank it as excellent and said it has helped them budget and manage their spending. There is some negative feedback though, with 9% of reviews rating it as bad and citing issues with withdrawing their money.

Alternatives to Cleo

Cleo has a few digital assistant rivals that help start a savings habit and we compare the basic accounts for each in the below comparison table. Some of the features in the table are available with the apps paid-for accounts. More information on the alternatives banking apps can be found in our reviews:

Cleo vs Plum vs Chip

A comparison between the basic free accounts for Cleo, Plum and Chip.

| Cleo | Plum | Chip | |

| Monthly cost | FREE | FREE | FREE |

| Automatic saving (using AI) | |||

| Budgeting features | |||

| Saving goals | |||

| Pre-paid debit card | |||

| Cashback | |||

| Interest | |||

| FSCS protection |

*this is a paid-for feature

Cleo vs banking apps

A number of the new challenger banking apps will also let you set up budgets, save and monitor your spending from your own account. Unlike Cleo they do not use artificial intelligence to save your money automatically but you can benefit from saving as you spend with roundups. Starling and Monzo both offer these types of services and operate under full FCA regulations so have FSCS protection. Find out more in our Starling review and Monzo review.

Pros and cons of Cleo

Pros of Cleo

- Accessible

- Useful spending insights

- Encouragement to start saving

Cons of Cleo

- Mainly for beginners

- No interest offered on products

- Basic functionality

Summary

Overall, Cleo makes budgeting and saving fun with the memes and 'Roasts' and can encourage you to save if you are not great at saving money each month. Cleo Plus is quite expensive at £5.99 for limited features but Cleo says it is working on adding more features over the coming months. If you want to find out more about apps similar to Cleo, you may find the following articles useful: