** evestor no longer offers wealth management services after striking a deal with Octopus Money in October 2023. Customers can read the latest developments here **

Robo-advisers and wealth management services are an increasingly popular and fast way to have your money managed and monitored online without the high fees of traditional financial advice. Nutmeg may be the market leader in the UK, with over £2billion of assets under management, but there are a host of other robo-advice services that are capturing market share. These include Wealthify, Moneyfarm and Wealthsimple.

Evestor is a relatively new entrant, launching in 2017, offering three portfolios investing in passive funds based on an investor's risk appetite. In this evestor review, I see how it stacks up against the competition.

Who is evestor?

Evestor is a robo-advice and portfolio management service aimed at investors of all ages and experience, letting users build an ISA, pension or investment portfolio from as little as £1 based on their individual investment profile.

Evestor has some big financial industry names behind it. One of its founders is Duncan Cameron. He knows all about disruptive businesses having launched comparison website MoneySupermarket back in 2003. His business partner is Anthony Morrow, founding shareholder of financial advisory group Paradigm. The biggest problem facing every new robo-adviser is client acquisition. The likes of Wealthsimple, Moneyfarm and even Scalable Capital have launched in the UK after having acquired significant customer and market share overseas. Insurance company AVIVA recently took complete ownership of Wealthify. It remains an independently run subsidiary of the AVIVA Group, which ultimately allows AVIVA to promote Wealthify to its existing extensive client bank. It will be interesting to see how evestor overcomes the customer acquisition issue. Given Moneysuprermaket’s meteoric rise, initially via word-of-mouth, I wouldn’t bet against Duncan Cameron repeating the trick with evestor.

Evestor is a trading style of OpenMoney Adviser Services Ltd. OpenMoney Adviser Services Ltd is authorised and regulated by the Financial Conduct Authority.

How does evestor work?

You don’t need a lot of money to start investing with evestor. The evestor minimum investment is just £1 through a direct debit. This makes it accessible to even novice investors. When compared with other robo services it is on par with Wealthify, which also has a minimum investment amount of £1.

In contrast, Moneyfarm and Nutmeg’s minimum investment is £500, while Scalable Capital has a £10,000 minimum. There are also no maximum investment limits with evestor but debit card transactions currently require a minimum of £1,000.

There are a couple of different ways to invest with evestor. Firstly, you can manage the whole process yourself, by choosing your preferred product, portfolio and investment amount with the help of a few online questions. Alternatively, you can request to speak to an adviser, where you will be connected to a support specialist via webchat. We explain each process in more detail later on in this article.

Evestor offers three different risk portfolios (covered in more detail later) combining bonds, equities, property and cash using passive index funds from respected brands such as Vanguard, Blackrock and Fidelity. These funds, also known as trackers, tend to be cheaper than active funds as you aren’t paying the salary and research costs of a management team. Essentially your fund is following the performance of a particular stock market. The funds track some of the most well-known benchmarks in their respected markets such as the FTSE All Share Index – the top 600 UK companies by market capitalisation – and the S&P 500.

Whichever you choose or are allocated, you can keep track of your portfolio using the evestor app, available on Android and iPhone. It may be a robo-adviser, but there is still a human touch as evestor offers live webchats and you can also book an online appointment to speak with an adviser.

What products does evestor offer?

Evestor offers a range of account options. You can access tax-free investing with an evestor ISA, or manage your retirement savings using the evestor SIPP (self invested personal pension.) Other robo-adviser's that offer a SIPP are Wealthify, Nutmeg, Wealthsimple and Moneyfarm.

There is also an Evestor General Investment Account for those looking for somewhere to simply make their money work harder.

In addition to its investments products, evestor provides money management advice through its website 'Open Money' which has a free app. The evestor website says "We decided to split the brand and in April 2019, OpenMoney was launched to cater for the advice side. Doing so allowed us to deal with both audiences specifically meaning better products, content and service. Evestor is a trading style of OpenMoney Adviser Services Limited".

One of the benefits of the app is that you can connect it to your bank, savings accounts, credit cards, loans and any other investments, meaning you can see it all in one place. While a neat idea, it isn't revolutionary and it is not something that can't already be done via market-leading budgeting apps such as Yolt and Emma. You can read our article "Best budgeting apps in the UK" to find out more.

How do they manage their portfolios?

Evestor works in a similar way to how most robo-advisers would deal with a client. They assign a portfolio based on one of three risk profiles and then regularly review how it is performing. The portfolio is not bespoke to any individual and all clients invested in the same portfolio receive the same service and returns.

The evestor portfolios are automatically spread across cash, equities and bonds to help reduce the risk and are rebalanced every six months. If you have concerns about the portfolio performance, you can speak to an adviser on the webchat service or book an appointment for a phone conversation.

Can you invest in ethical funds with evestor?

No. Evestor's portfolios invest in several mutual index funds which means that they track global market indexes like the US S&P500 and the UK FTSE All-Share. As such, they are unable to filter out specific stocks that are considered to be unethical. Other robo-advisers such as Wealthify, Nutmeg and Wealthsimple do provide investors with the ability to invest in portfolios that are ethically minded. These portfolios can sometimes be referred to as Economic Social and corporate Governance (ESG) or Socially Responsible Investing (SRI). Evestor says "Currently we are unable to remove specific investments which may be considered unethical...Whilst this market progresses, our investment committee are keen to explore the low cost options available for our customers"

What are evestor’s fees?

Evestor fees vary depending on the chosen portfolio and are made up of the underlying fund charge and platform servicing fee. Evestor charges a management fee of 0.25%, an administration fee of 0.10% (paid to a third party) and fund fees of between 0.11% and 0.14% depending on what portfolio you are invested in. We have provided a table below that the total fees for each of its portfolios.

Evestor fees explained

| Low Risk Portfolio | Medium Risk Portfolio | High Risk Portfolio | |

| Management fee | 0.25% | 0.25% | 0.25% |

| Administration fee | 0.10% | 0.10% | 0.10% |

| Fund fee | 0.14% | 0.12% | 0.11% |

| Total fee | 0.49% | 0.47% | 0.46% |

When comparing these costs to other robo-advisers it is important to take other factors into consideration such as the number of portfolios on offer (including whether there is an option to invest ethically) and of course the performance.

Wealthify charges a flat fee of 0.60% and average fund fees of around 0.22%. Nutmeg charges 0.75% on funds up to £100,000 and 0.35% on anything above that for its fully managed portfolios. There is also an underlying fund charge of 0.19% plus 0.08% to cover transaction costs. Nutmeg does also offer fixed allocation portfolios where the asset mix never changes which makes them cheaper to run, starting at 0.45% per annum. Moneyfarm typically charges 0.75% for investments worth up to £10,000, 0.6% on £10,001 to £50,000, 0.5% on £50,001 to £100,000 and 0.35% on over £100,000 to £500,000. Wealthsimple charges 0.7% per annum which is reduced to 0.5% for clients who invest more than £100,000.

evestor’s portfolio performance

Below, we provide the performance data for evestor's low, medium and high risk portfolios for 2018, 2019 and 2020.

evestor performance

| Year | Low Risk Portfolio | Medium Risk Portfolio | High Risk Portfolio |

| 2018 | -2.48% | -5.05% | -7.04% |

| 2019 | 8.27% | 14.40% | 17.49% |

| 2020 | 5.09% | 2.79% | 2.42% |

The performance of all three evestor portfolios is a little disappointing, especially when compared to other robo-advisers that offer portfolios with similar asset mixes. With ESG and SRI portfolios performing particularly well in recent years, the lack of an ethical investing option could see investors seeking alternative options in a bid for better returns. Check out our article "Which is the best performing stocks and shares ISA?" for more detail.

evestor’s portfolio asset mix

Below, we provide a breakdown of the asset mix for each of the evestor portfolios.

| Asset | Low Risk Portfolio | Medium Risk Portfolio | High Risk Portfolio |

| Fixed interest | 67% | 31% | 3% |

| Equities | 30% | 61% | 89% |

| Property | 0% | 5% | 5% |

| Cash | 3% | 3% | 3% |

The low risk portfolio invests primarily in defensive assets such as cash (3%) or bonds (67%), with a small proportion in equities (30%). This is to ensure any losses are limited. The medium risk portfolio increases exposure to equities (61%) and property (5%) to add more risk and a greater capacity for returns. The high risk portfolio is for those comfortable taking more risk for an opportunity to get better returns. There is more exposure to emerging markets, with 89% currently in equities overall. Something to be aware of however is that the asset mixes are not regularly reviewed. The asset mix of the high risk portfolio has not changed for over 2 years.

How does evestor compare?

Evestor’s closest rivals are Wealthify, Nutmeg and Moneyfarm. All four robo-platforms will ask questions about your income and investment goals as well as how much risk you are prepared to take and will then come up with a recommended portfolio that will be regularly monitored and rebalanced (less so it seems with evestor). In each instance you can be screened-out by the online questionnaires for not being suitable to invest if you have excessive debts or no cash savings. However, you can simply alter your previous answers to the questions in order to get through the screening process which does make the whole thing seem a token gesture.

Despite the similarities between the four services, there are some differences in where your money will go.

evestor vs Wealthify

Evestor offers three portfolios whereas Wealthify allows investors to choose between five standard and five ethical portfolios, giving a choice of ten overall. In addition to an ISA, general investment account and SIPP, Wealthify allows investors to open a Junior SIPP. You will pay higher fees with Wealthify with management fees of 0.60% and average fund fees of 0.22%, totalling 0.88%. This compares to total average fees of between 0.46% and 0.49% with evestor. Wealthify has a better track record when it comes to performance, important when you consider that the performance figures that we highlight in our article "Which is the best performing stocks and shares ISA?" are after fees have been deducted.

evestor vs Nutmeg

Evestor comes up with three portfolios depending on your answers, while Nutmeg has a total of 30, including a range of fully managed, socially responsible and fixed allocation portfolios. The portfolios are regularly reviewed depending on market conditions and users will receive regular investment strategy updates and can watch video explanations on Nutmeg’s website.

Both will let you open an ISA, SIPP or general investment account. Investors using evestor will have their money allocated to tracker funds, but Nutmeg uses exchange traded funds (ETFs) which tend to be cheaper than tracker funds.

evestor v Moneyfarm

Moneyfarm assesses investors as low, medium and high risk depending on their answers to certain questions. Their funds are then split across 7 portfolios investing in ETFs, based on risk and the amount invested.

It offers a general investment account, ISA and also a SIPP. Read our full Moneyfarm review for more details, especially on their favourable performance and charges vs their peers.

The signup process

When signing up to evestor you first need to enter your email and will then be sent a registration link that will take you to the slick-looking evestor portal. This is where you will need to fill in your name and date of birth and create a password.

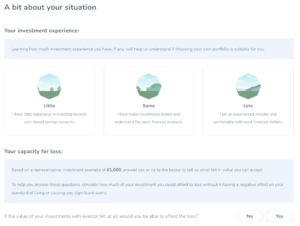

You can then access your online dashboard, where you can view your account performance, documents and messages and book appointments with a financial adviser. There is a “Get products” link that will take you through a number of questions in a bid to understand your investing experience, capacity for loss and attitude to risk.

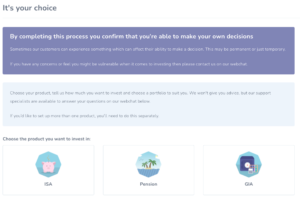

Once you have answered the first three questions you will be presented with a choice of products (ISA, Pension or General Investment Account), how much you would like to invest and which portfolio you would like to invest in. Evestor make it clear that by completing these questions, you confirm that you are able to make your own investment decisions. It offers vulnerable customers the option of chatting via its webchat function.

If you choose the 'Speak to an advisor' option from the dashboard then you will be invited to start a live webchat with one of its fully trained webchat team members. Available from 9am to 8pm Monday to Friday.

What other services do they provide?

You can book a phone appointment to discuss any concerns about your portfolio. However, it has chosen to only provide investments through passive funds. If you are a fan of active management then this may not work for you.

It’s worth remembering that a robo-adviser only provides investment advice, whereas an IFA will also offer wider financial planning that would also link your other needs such as insurance.

What protection is there from evestor going bust

Evestor is regulated like any financial adviser or provider. Your savings are held by a third-party platform provider in a separate client money bank account. This protects you from evestor being able to access and run off with your money before it is invested.

Any cash held in a client money account before it is invested is covered by the Financial Services Compensation Scheme (FSCS). This means you would get up to £85,000 of your savings back if the client money account provider went bust while holding your cash. You are also protected up to £85,000 once your money is invested thanks to the same Financial Services Compensation Scheme. This does not protect you against poor stock market performance though.

Conclusion

Evestor offers a simple-to-use and cost-effective investment service with advice on-hand, similar to the likes of Wealthify, Nutmeg and Moneyfarm.

The platform also provides money management advice through its 'Open Money' website and app and looks at whether it is worth transferring your current savings. This additional bit of hand-holding will win some fans but with only three portfolios and investment performance that lags some of its peers, the likes of Wealthify, Nutmeg and Moneyfarm will prove a draw to potential evestor customers.

Evestor alternatives

There is a big market for robo-advisers and you should take a look at all services to see which type is best for you.

We have already mentioned Wealthify, Nutmeg and Moneyfarm. Wealthify in particular stands out due to its low fees and strong performance. It also offers a Junior ISA in addition to its ISA, General Investment Account and SIPP products.