** On the 6th December 2021, Wealthsimple announced that it was withdrawing from the UK investment market. Read our article 'Wealthsimple withdraws from UK market" for further information. **

** On the 6th December 2021, Wealthsimple announced that it was withdrawing from the UK investment market. Read our article 'Wealthsimple withdraws from UK market" for further information. **

In this independent Wealthsimple review I analyse the Wealthsimple proposition and look at Wealthsimple's investment performance, fees and compare Wealthsimple vs Wealthify*, Nutmeg and Moneyfarm*.

As part of this review, I visited Wealthsimple's central London offices to grill them over their investment process, their proposition and their ethics. The review is broken down into key parts and you can jump to a relevant section using the jump links in the sidebar (or via the Contents Menu above if you are viewing this on mobile). However, I suggest that you take your time to read this Wealthsimple review from beginning to end as I make important observations throughout when comparing the service against other robo-advisors in the UK.

Who is Wealthsimple?

Wealthsimple is an online investment manager (often referred to as a robo-advisor) which was first launched in Canada in 2014 and subsequently launched in the UK in September 2017. In the UK, Nutmeg is the robo-advice firm with the largest market share. However, with the exception of Nutmeg, most of the robo-advisors now available in the UK have come from abroad. For example, Moneyfarm launched in the UK after successfully establishing itself in Italy while Scalable Capital hails from Germany. The UK market has a huge potential appetite for cost-effective managed investment propositions offered by robo-advice firms online.

The UK DIY investment market is dominated by platforms such as Hargreaves Lansdown where investors can choose their own funds from a range of thousands. However, robo-advisers offer a range of off-the-shelf portfolios managed by their investment experts and computer algorithms which makes them ideal for investors (particularly novices) who want to invest while keeping costs low yet who don't have the time or expertise to run their own portfolios. As an aside if you do use an investment platform such as Hargreaves Lansdown and would like help in deciding which funds to invest in as well as learning more about investment markets then 80-20 Investor will interest you.

Wealthsimple continues the trend of successful overseas robo-advice firms launching in the UK, but this time it is coming from the West, namely Canada and the US. Whenever I look underneath the bonnet of a robo-adviser I look at how sustainable their business models potentially are. Robo-advice firms charge very low fees so have incredibly slim profit margins. In order to eventually run at a profit they require a large volume of customers and/or substantial financial backers. In the world of online wealth management it is a race to £1bn AUM (assets under management) as this is generally accepted to be the point when their business models become profitable. Wealthsimple's AUM when you combine the US, Canada and the UK is in excess of £6.4bn and has grown its customer base to over 1.5m clients. That's no mean feat in a competitive market such as the US which has been dominated by low cost platforms such as Vanguard.

In addition, the Power Financial Group, one of the world's largest financial companies, has backed Wealthsimple with $100m of investment and in May 2019 Allianz X, a leading Germany-based global insurer and asset manager, backed Wealthsimple with a further $100m of investment. So in that regard I have little concern over Wealthsimple as a company to invest with, of course, your investments are ring-fenced and protected anyway in the unlikely event that the company went bust, which is the same for any robo-advisor regulated in the UK.

How does Wealthsimple work?

Minimum investment

Wealthsimple has no minimum investment amount (unlike most of its competitors) if you want to invest in its standard portfolios and its low fee strategy will prove attractive to a range of investors which we discuss later. If you want to invest in one of its newer Socially Responsible Investing (SRI) portfolios then there is a minimum investment amount of £5,000. Those who have less to invest may want to look at Wealthify* where you can invest in one of its five ethical portfolios from as little as £1.

What is the Wealthsimple sign up process?

Opening a Wealthsimple account is relatively straightforward. Firstly, you'll need to register by providing an email address and secure password. You'll then be taken through a series of screens, providing your date of birth, address and National Insurance Number (in order for Wealthsimple to confirm your identity). Once registered, you will be presented with a multiple-choice questionnaire asking why you are planning to invest, as shown below (click to enlarge):

Once you have selected a reason you are taken through a short multiple-choice questionnaire asking some basic information about your investing experience and personal circumstances. This is similar to most of the other robo-advisers in the UK but it has a slightly more streamlined feel to it. The questions asked include those listed below and are standard fare for any robo-advisor:

- How long are you looking to invest for?

- What's your monthly income after tax?

- What are your monthly outgoings?

- Do you anticipate any negative changes to your income or outgoings in the near future?

- What's the combined value of any investments and cash you have?

- How much debt have you got?

- How much emergency cash do you have?

- How much investment experience do you have (if any)?

- How you would react to a number of suggested investment scenarios?

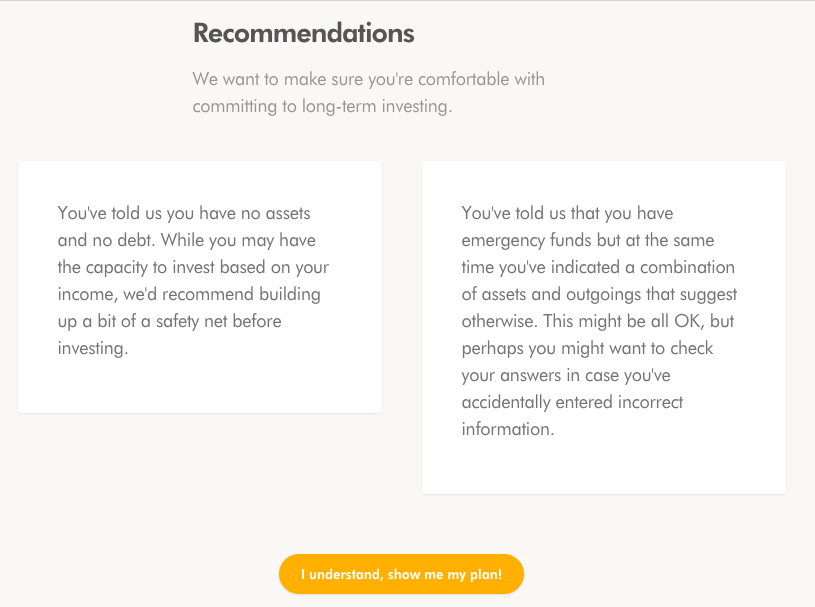

You are then presented with a recommendation screen like the one below which is based upon how you answered the questionnaire (click to enlarge).

Wealthsimple does not screen users out if investing is unsuitable for them, like services such as Scalable Capital and Wealthify do. For example if you do not have an emergency cash fund Wealthsimple will warn you on the recommendation screen that investing isn't for you but it doesn't stop you proceeding. That said, I was impressed to receive an email from Wealthsimple not long after completing my questionnaire, inviting me to discuss my investment plan and risk score, so there is clearly a safety net in place which some novice investors will find comforting.

What I like about the Wealthsimple approach is that you are presented with a portfolio to invest in which lists the exact funds they recommend. No other robo-advice firm does this, preferring to only tell you the specific funds once you invest, so I applaud Wealthsimple's transparency. This may have been in part because Wealthsimple could not publish its investment performance data when it launched in the UK as it didn't have one. So by showing the third party funds that it planned to invest in it at least could demonstrate its investment process. However, the good news is that Wealthsimple now has a two-year performance track record which I analyse later in this article.

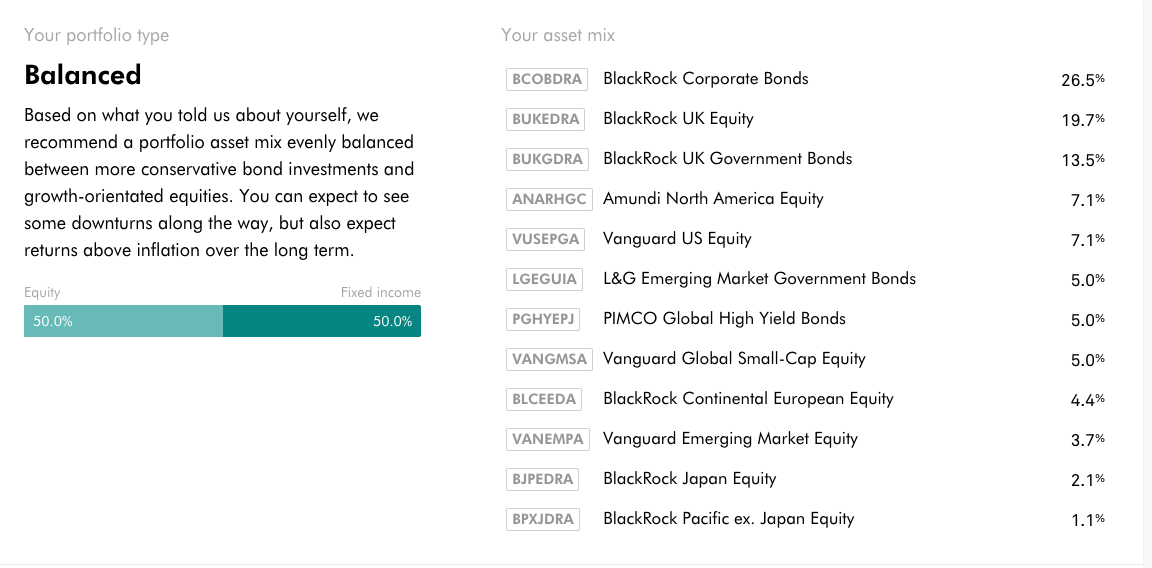

Below is the exact portfolio of funds that Wealthsimple recommended for me as a medium risk profile (click to enlarge).

Overall the portfolio is well diversified across assets globally and certainly isn't US focused which is a criticism that can be directed at its US peer Vanguard in relation to its Lifestrategy funds. Wealthsimple use exchange-traded funds (ETFs) and low cost mutual funds in order to keep costs low. All investments are then regularly managed and rebalanced to ensure the asset mix remains in line with the client's goals.

Wealthsimple has 9 portfolios in its 'non socially responsible' range, with 3 portfolios available within each risk level. The 3 risk levels are conservative, balanced and growth. There are a further 9 portfolios available in its 'socially responsible' range if you would prefer to invest ethically. You can take a look at the asset mix of each Wealthsimple portfolio and you can also check out the funds that Wealthsimple invest in.

With Wealthsimple you have the option to invest in the portfolio via a Wealthsimple Stocks and Shares ISA, Junior ISA (which is an exciting and rare option among robo-advisers), via a pension or via a general trading account outside of any ISA wrapper.

If you decide to invest you can monitor and manage your Wealthsimple account online or via its smartphone app. After having a hands-on look at the app I can confirm it's easy to use (you can even make additional contributions through it which is ideal for the self-employed) although it won't necessarily win any design awards, but that's not really the point. What I do like is Wealthsimple's commitment to providing personal finance articles within its app and online to help educate customers. These can range from interviews, to money-saving tips or even financial planning and it gives users a reason to engage with their Wealthsimple account on a regular basis.

What products does Wealthsimple offer?

Wealthsimple offers the usual Stocks and Shares ISA and general account like its peers but more notably it also offers a low cost a Junior ISA account. Robo-advisors have been slow or reticent to offer their services via a Junior ISA because of the low annual contribution limits, currently £9,000 for the 2021/22 tax year. In their race to acquire assets under management they have tended to focus on Stocks and Shares ISAs (with their annual contribution limit of £20,000). Also most allow new customers to transfer their existing ISA portfolios across too so they can be managed by the new robo-advisor. Wealthsimple now also offers a pension product making it one of the few robo-advisers in the UK to do so. The only other robo-advice firms to offer a pension are Wealthify, Nutmeg, Moneyfarm and evestor.

Given Wealthsimple's lack of a minimum investment threshold, the service lends itself perfectly to those looking to invest for their children via a Junior ISA or wanting to invest smaller sums initially into a pension. Also, transfers into a Junior ISA (or indeed the general investment account or Stocks and Shares ISA) are straightforward and free of charge.

Wealthsimple is one of only a few robo-advisors offering Socially Responsible Investing (SRI). This means investing in companies that reach a certain threshold of social responsibility. Examples of ETFs used with SRI include companies with low carbon exposure, gender equality in senior leadership and those supporting local initiatives.

How does Wealthsimple manage its portfolios?

Wealthsimple will regularly manage each client's portfolio by rebalancing the assets held to ensure that they stay on track to reach their financial goals. Every client is different in their investment timeframe and goals and therefore have different investments in their portfolios, this is known as asset allocation. To keep the investments in line with each client's investment goals this asset allocation needs to be monitored regularly. Of course, this is pretty standard for any robo-advice proposition.

What is Wealthsimple's investment strategy?

Wealthsimple's investment strategy is split into three categories.

- Diversification - spreading investments across different asset types is a key driver of portfolio performance. Wealthsimple invest in global equities and bonds providing a wide range of choices to create the best portfolio for each client (as shown in my example earlier).

- Passive management - which principally involves investing in low-cost funds or ETFs that track specific investment markets.

- Client control - portfolios are created for each individual client bearing in mind their investment goals and attitude to risk.

What are Wealthsimple's fees?

Wealthsimple has a low-cost fee strategy by charging 0.7% per annum. The standard annual fee is reduced to 0.5% for clients who invest more than £100,000. This is known as their black package which includes a financial planning session with one of Wealthsimple's expert advisers. Wealthsimple also has a 'generation' package for people who invest over £500,000. The charges are the same as the 'black' package but you also get a dedicated investment adviser, cashflow planning and ongoing portfolio monitoring.

The different packages are a nice touch and show that Wealthsimple is the only robo-adviser to recognise that wealthier clients want exclusivity and additional benefits.

On top of the above management fees, there is an additional fee of around 0.20% applied to your investments which is charged by the underlying funds. This underlying fee is on a par with the likes of Nutmeg and Moneyfarm as shown in the next section.

Fees are calculated on a daily basis using the closing balance on your portfolio for each day. The charges will be accrued and applied to the client's account on a monthly basis.

Wealthsimple believes that as an investor, you should be free to move your money without penalty and so they will not charge you if you wish to move your money to another provider. So strong is their belief on transfer charges that if you wanted to transfer money to Wealthsimple, they will cover the fees levied by your old provider. To qualify, your ISA, general investment or pension account must be worth more than £5,000 and the offer does not include any charges related to the product (such as fees on the sale of the asset).

How does Wealthsimple's fees compare to other robo-advisers?

One of the key attractions of robo-advisors is the low fees charged for managing a client's investments, but these fees do vary across the various advisors.

Wealthsimple fees compared to Wealthify, Nutmeg, Moneyfarm and Scalable capital:

| Provider | Initial fee | Fee reductions | Ongoing fee |

| Wealthsimple | 0.70% | Reduced to 0.50% for investments over £100,000 | 0.20% |

| Wealthify | 0.60% | N/A | 0.22% |

| Nutmeg | 0.75% | Reduced to 0.35% for investments over £100,000 | 0.19% |

| Moneyfarm | 0.75% | Reduced to 0.60% for investments between £10,001 and £50,000, 0.50% for investments between £50,001 and £100,000 and 0.35% for investments over £100,000 | 0.20% |

| Scalable Capital | 0.75% | N/A | 0.25% |

So you can see that Wealthsimple has pitched its charges below most of its competitors although there are cheaper alternatives than Wealthsimple for investors with sums over £100,000, namely Nutmeg's fixed asset portfolio but they are not directly comparable as they are not actively managed.

Wealthify reduced its charges in December 2019 to a flat fee of 0.6% making it the cheapest robo adviser if investing less than £20,000. It's also important to stress that there are no exit fees so if you decide to transfer your money away from Wealthsimple in the future you won't be penalised.

Wealthsimple portfolio performance

As Wealthsimple launched in 2017 they have a track record going back three years. Their balanced portfolio (known as Risk Level 5 has a 60% equity exposure) has grown by 30.19% (net of fees) since the portfolio was launched on July 6th, 2017 (up to 30th June 2021). Below, I have compared Wealthsimple's performance in the last three and a half years to the average professionally managed fund out there with similar equity content.

| Performance | Wealthsimple Balanced portfolio performance |

Average managed fund 40-85% equity performance

|

| 1 year (12 months to 31st June 2021) | 15.58% | 17.93% |

| Since inception (6th July 2017 to 1st June 2021) | 30.19% | 27.56% |

Wealthsimple v Nutmeg v Moneyfarm v Wealthify

Of course what investors really want to know is how Wealthsimple's performance compares to Nutmeg, Moneyfarm and Wealthify, three of the leading robo-advice firms in the UK. The table below shows the actual performance figures. The table below compares the actual performance of the medium risk portfolios from Wealthsimple, Moneyfarm, Nutmeg and Wealthify. The figures are based on the performance for the whole of 2020.

Wealthsimple v Nutmeg v Moneyfarm v Wealthify performance comparison

| Investment |

% Return in 2020

|

| Wealthsimple medium risk SRI portfolio | 12.74% |

| Wealthify medium risk 'confident' SRI portfolio | 9.04% |

| Wealthsimple medium risk portfolio | 7.12% |

| Nutmeg medium risk SRI portfolio 5 | 6.80% |

| Wealthify medium risk 'confident' portfolio | 4.87% |

| Nutmeg medium risk portfolio 5 | 4.60% |

| Moneyfarm medium risk portfolio 4 | 2.50% |

Does Wealthsimple provide any other service?

Interestingly Wealthsimple customers are able to talk to an adviser should they want to. This could be to ask questions about setting up an account or requesting full-blown investment advice, the latter Wealthsimple provides for free if you invest over £500k. This is a hugely underplayed part of the service and I think Wealthsimple should make more mention of it in its marketing as most other robo-advisors don't offer this. A lot of UK consumers are interested in investing online and many would welcome the flexibility and comfort of knowing that there is a human at the other end of a phone

What protection is there from Wealthsimple going bust?

All assets are held securely by a custodian and protected under the Financial Services Compensation Scheme (FSCS) up to a limit of £85,000.

Conclusion - Who should consider Wealthsimple?

Wealthsimple is an interesting addition to the world of robo-advisers and its simple low-cost fee strategy definitely makes it worth consideration. If you are looking for a service to manage your money and make strategic investment decisions (rather than just giving you a fixed asset allocation forever) then Wealthsimple is one of the cheapest services out there. Its portfolio and investment methodology are on a par with its peers and it has outperformed its peers over the last year, especially when it comes to socially responsible investing. I particularly like its Junior ISA product which gives access to low cost investing. Its lack of minimum investment amount makes it particularly attractive to investors looking to invest smaller amounts, along with Wealthify*. However, it remains keenly priced even if your portfolio is worth up to £100,000.

All accounts can be seen at once via its app, so if you have a Stocks and Shares ISA and a Junior ISA you can view them at the same time. Wealthsimple's service is based upon sound ethic principles which have proved hugely successful in the US and will almost inevitably do so in the UK given its financial backing. Wealthsimple is very cost-effective and offers the ability to speak to an investment adviser if you wish too. Wealthsimple's proposition is ideally placed to attract millennial and older seasoned investors alike who want someone to manage their money for them. The fact that there is no investment minimum on its standard portfolios and it offers a junior ISA and a pension product makes it a good solution for those wanting to dip their toe into the online investment (robo-advice) world before committing larger sums.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses - Wealthify, Moneyfarm