Who is Netwealth?

Who is Netwealth?

Netwealth* is a wealth management service, launched in the UK in 2016, that seeks to combine a qualified team of advisors with a strong online service and an investment framework that uses cutting-edge technology. The approach is designed to allow clients to access Netwealth's online investment service and engage with a financial advisor at any time.

Somewhat confusingly there appears to be an Australian Netwealth which shares an almost identical url which operates under the same company name as the UK version (Netwealth Investments Limited). However, they have different branding and neither site makes any reference to the other. So without any clear connection between the two sites, users must assume they are separate entities. Yet such confusion is far from ideal as is evident below when I encounter the Australian firm's mobile app whilst unsuccessfully looking for the UK site's own version.

1 minute summary - Netwealth review

- Netwealth* provides a wealth management service and offers online planning tools, designed to help customers create the right portfolios to achieve their financial goals

- Invest in an ISA, Junior ISA, Self Invested Personal Pension (SIPP) or General Investment Account (GIA)

- Sign up for free access to the MyNetwealth dashboard* where you can track all of your investments in one place

- Fees from 0.40%

- Minimum investment is £5,000

How does Netwealth work?

Netwealth is primarily a wealth management service offering online planning tools designed to help customers create the right portfolios that will achieve their financial goals. Portfolios are created using passive funds and exchange-traded funds (ETF) which provide exposure to markets whilst reducing the impact of costs on investment returns. In addition to the standard online service, it provides access to professional advisers with the aim of providing a comprehensive service often required by investors who are looking for guidance in maximising their investment returns.

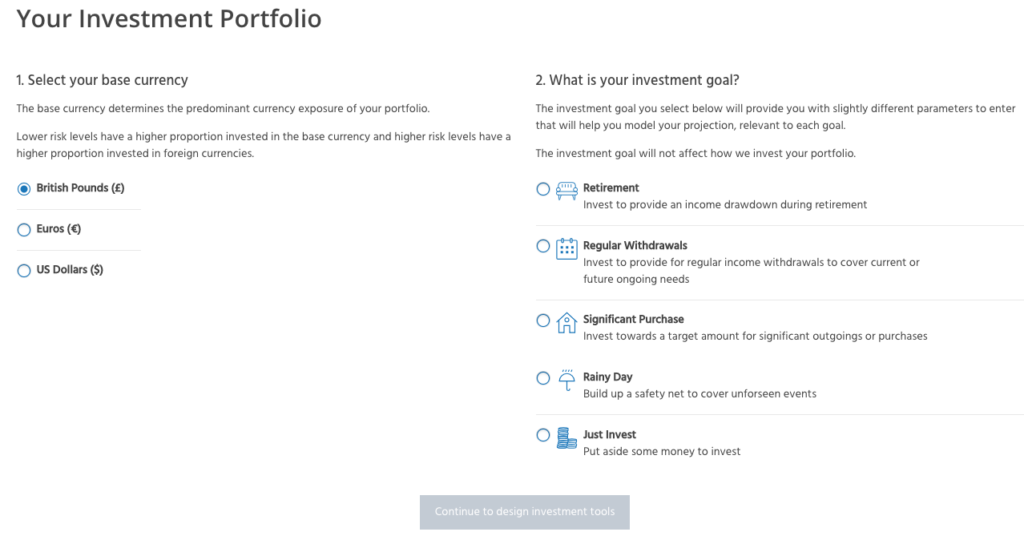

When you first open an account with Netwealth the only information that they request is your name, email address and a password. Once you accept the terms and conditions you can access the “design an investment” section (image below).

At this point you are given the choice of 5 investment goals to choose from:

- Retirement – invest to provide income and drawdown in retirement

- Regular withdrawals – invest to provide regular income withdrawals

- Significant Purchase – invest towards a target amount for significant outgoings and purchases

- Rainy Day – build a fund that will cover the cost of unforeseen events

- Just Invest – general investing

Once you select your goal you are requested to enter the investment type, the level of contributions (initial contribution and the ongoing monthly contributions) and finally the risk level you are comfortable with. It has changed this process slightly and is different from when we originally reviewed Netwealth and the risk level is now the last thing you select, meaning you can easily jump back and forth and see how the different risk levels impact the performance; a minor niggle last time, and it is pleasing to see that Netwealth has listened to feedback and improved the user experience. Once selected you are presented with a number of graphs showing “Simulated Past Performance” along with “Best and Worst Returns over a 12 Month Period”.

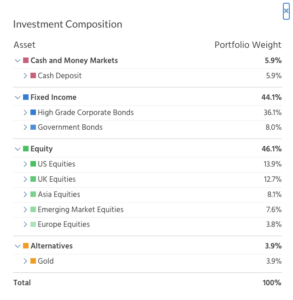

By clicking on the “Full details of holdings' button, you can see the full asset allocation, as well as the weighting. Below is the investment composition for the portfolio titled ‘Risk level 4'. Click to enlarge.

Netwealth has a minimum initial contribution of £5,000 which you only find out when you are presented with an error message if you try to enter less than that amount. Technically Netwealth has a minimum investment of £50,000 but under the terms of their Netwealth Network (see later) it is technically possible to open an ISA with £5,000.

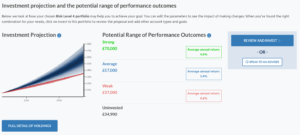

Next you are presented with an investment projection that shows the potential range of investment outcomes. You can then choose to review and invest or speak to an adviser. When we last reviewed Netwealth you were able to save at this point and it seems a shame that it has removed that option.

The investment projections highlight potential outcomes which fall within a broad range. This is fairly standard for robo-advisers as the absence of a long track record (many launched within the last 10 years) often prevents them from displaying their actual past performance.

A notable omission from the Netwealth sign-up experience from previous reviews of the service was any form of risk profiling questionnaire. In the early days of robo-advisers this approach was very common but now many of the larger organisations like Wealthify, Nutmeg and Moneyfarm take new customers through risk profiling questionnaires so they can ascertain which of their portfolios may be most suitable. In addition, this profiling exercise also helps screen out potential users whose circumstances mean that investing is really not suitable for their needs (e.g if they have no savings and/or have outstanding debt). I'm pleased to say that this has since been addressed and is particularly important given that the advertised minimum investment with Netwealth is £50,000. The Netwealth sign-up experience now includes a ‘Suitability' section which states “As part of the account opening process we will collect details of your financial circumstances as well as your knowledge and experience of investing. We will use this information to assess your capacity for loss and will review your choice of risk level relative to your capacity for loss to ensure the portfolio of investments is suitable for your circumstances. If we require any further information in order to assess your circumstances we may contact you directly”

Netwealth has developed a mobile app which customers can use to manage their investments on the go. Rather confusingly there is another Netwealth app in the Apple and Google app store that appears to be solely for Australian customers of the aforementioned Australian company (of the same name).

What products does Netwealth offer?

Netwealth offers the following accounts:

General Investment account – allowing customers to invest across seven different risk levels. There is also an option to open a Junior general investing account.

Self Invested Personal Pension – including transfer in and consolidating pensions

ISA & JISA – providing tax-free growth on investments

Charity, Trust and Corporate Accounts – a discretionary management service also offering cash flow planning.

Ethical investing – Netwealth offers a range of SRI portfolios that have increased exposure to investments that have high environmental, social and governance ratings.

MyNetwealth – MyNetwealth* is a free personal wealth dashboard that allows users to track their wealth across all of their investments and plan for a number of different outcomes. It offers a modern approach to wealth planning combining technology with human expertise, overseen by Netwealth's team of qualified financial advisers. Importantly, you do not need to be a Netwealth customer to access the service.

How does Netwealth manage its portfolios?

Netwealth portfolio management is an ongoing process using an experienced investment team. They state that investment managers meet regularly to discuss any economic or market risks that could affect long-term portfolio performance. Any adjustment to portfolios is made within a low-cost environment and the client's risk profile. Netwealth will monitor and review your portfolio annually and go one step further than the likes of Moneyfarm and will flag you and follow it up with a phone call if they believe you should take action.

What is Netwealth's investment strategy?

Netwealth's investment process has three parts:

1. Building Strategic Allocations

Netwealth's long-term mix of asset class exposure is the main driver of its portfolio returns through the investment cycles of its seven risk levels. A broad range of assets is considered for inclusion in its portfolios to provide exposure to assets classes that perform well in different economic circumstances.

2. Selecting Portfolios

Netwealth invests predominately in passive funds and exchange-traded funds (ETFs). These funds provide a diversified exposure to each asset class in a cost-effective way.

3. Adopting Cyclical Positions

Netwealth investment managers monitor markets regularly and make cyclical adjustments to portfolios to address economic or market risks. Any cyclical adjustments will not affect the risk profile or cost of individual portfolios.

Does Netwealth offer financial advice?

Netwealth does offer financial advice on a restricted basis and can only give advice that relates to their own products and services and therefore they do not consider the whole market. As a registered user there are a number of prompts to engage with one of their advisers which will reassure new users. However, given that a number of robo-advisers are starting to offer advice (e.g Nutmeg and Moneyfarm) this service is fast becoming standard practice. Given the restricted nature of Netwealth's advice I would always urge investors to seek advice from an independent financial adviser who can give advice based on the whole market if investors are not confident in making their own decisions.

The fees for financial advice through Netwealth is as follows:

- One off advice – £200 per hour

- Ongoing advice – 0.35% per annum on the value of your account, subject to a minimum fee of £1,000 per annum

What are Netwealth's fees?

Netwealth's fees* reflect the fact that users are not receiving a truly bespoke service and are therefore low cost as a result:

- £50,000 to £249,999 – 0.70%

- £250,000 – £999,999 – 0.55%

- Over £1m – 0.40%

In addition to the above, there is also an underlying fund charge of 0.20% and estimated trading costs of 0.10%. Netwealth also offers an investing network service (Netwealth Network) where a customer can invite up to seven family members or friends to join their network to collectively benefit from cost reductions. The fees that each member pays are calculated on the total invested amount of all members of the network. So if seven members each invested £50k they would all qualify to receive the reduced fee of 0.55% normally reserved for individual investors who have £250,000 to £999,999 invested with Netwealth. The Netwealth Network also allows invited individuals to invest a minimum of £5,000 in their ISA rather than opening their own Netwealth account which requires a minimum investment of £50k. The portfolio of each invited member is managed separately by Netwealth, they simply share the same fee structure as their counterparts. This is an interesting way for customers to collectively reduce their fees (as long as the initial investor still meets the minimum investment requirement of £50k) even if in reality it is a thinly disguised “member get member” marketing initiative.

How do Netwealth's fees compare to Nutmeg, Moneyfarm and Wealthify?

In the below comparison table we compare Netwealth's fees with popular robo-advisers Wealthify, Nutmeg and Moneyfarm.

| Robo-adviser | Fees (Not including underlying fund charges) | Annual cost of investing £50,000 | Annual cost of investing £100,000 | Annual cost of investing £250,000 |

| Netwealth | £50,000 – £249999 – 0.70%

£250,000 – £999,999 – 0.55% Over £1m – 0.40% |

£350 | £700 | £1,750 |

| Wealthify | A simple flat fee of 0.60% across the whole portfolio | £300 | £600 | £1,250 |

| Nutmeg | £500 – £100,000 – 0.75%

Over £100,000 – 0.35% |

£375 | £750 | £1,200 |

| Moneyfarm | £500 – £9,999 – 0.75%

£10,000 – £24,999 – 0.70% £20,000 – £49,999 – 0.65% £50,000 – £99,999 – 0.60% £100,000 – £249,999 – 0.45% £250,000 – £499,999 – 0.40% Over £500,000 – 0.35% |

£300 | £450 | £1,000 |

Netwealth portfolio performance

Below are the returns, net of all fees for each of the 7 Netwealth portfolios since inception.

| Netwealth Portfolio Risk Level | % Return since inception (31st May 2016 to 30th June 2023) |

| Risk Level 1 | 6.6% |

| Risk Level 2 | 15.7% |

| Risk Level 3 | 23.0% |

| Risk Level 4 | 34.6% |

| Risk Level 5 | 45.1% |

| Risk Level 6 | 56.8% |

| Risk Level 7 | 69.3% |

What investors will likely want to know is how this performance stacks up against the likes of Wealthify, Nutmeg and Moneyfarm, three of the leading robo-advice firms in the UK. The table below shows the actual performance in the last 12 months (up to June 2023) of Netwealth's medium risk portfolio (Risk level 4) versus the comparable portfolios on offer from Wealthsimple, Nutmeg and Moneyfarm.

| Investment | % Return in the last 12 months |

| Netwealth medium risk portfolio 4 | 2.8% |

| Wealthify medium risk (Confident) portfolio | N/A |

| Nutmeg medium risk portfolio 5 | 1.2% |

| Moneyfarm medium risk portfolio 4 | 2.8% |

What protection is there from Netwealth going bust?

Netwealth clients' assets are held by a third party, SEI Global Nominee Ltd, who are regulated by the Financial Conduct Authority and investments are protected under the Financial Services Compensation Scheme up to £85,000 per client.

Who should consider Netwealth?

Overall Netwealth* offers a slick online proposition but with such a high minimum investment requirement of £50,000, it is clearly hoping to attract clients from the higher end of the wealth management market. Netwealth is aimed more towards affluent investors who are already familiar with Netwealth's more traditional discretionary wealth management services (and who may even want to visit their offices for face-to-face meetings, which is possible). It would also suit those who want a more streamlined (and therefore cheaper) management approach.

Those interested in wealth planning should check out MyNetwealth* as it provides a number of useful tools. The service is free and you don't need to be a Netwealth customer to sign up. For investors seeking a low-cost investment solution that will manage their investments with low minimums and easy to use mobile apps, it is worth reading our reviews of Nutmeg, Moneyfarm and Wealthify who are some of the most popular robo-advisers in the UK.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses – Netwealth