For alternative options visit our articles:

Best Junior Stocks and Shares ISA

A new investment proposition from insurer VitalityLife aims to address the shortfall in long-term savings by incentivising people to save more for retirement while also looking after their health. But how does it work, who could it benefit, and what are the downsides? This VitalityInvest review kicks the tyres to find out.

What is Vitality Invest

VitalityLife is an insurance brand owned by Discovery, a South African insurer with a large global presence and more than five million customers worldwide. It sells health and life insurance and is based on the concept of rewarding customers for their efforts to live a healthier lifestyle. The group launched the concept in the UK in 2007 alongside Prudential, creating PruHealth and PruProtect, before Discovery bought out Pru’s stake in the joint venture in 2014. It now trades here under the VitalityHealth and VitalityLife brands and its latest addition is VitalityInvest. You might recognise its adverts featuring Olympian Jessica Ennis-Hill and a sausage dog.

Life insurance customers can earn Vitality points for things like going to the gym, eating more healthily, or visiting the dentist. These points can then be exchanged for perks and cashback, spa breaks and Apple watches, as well as discounts of up to 40% on insurance premiums.

Incredibly, Vitality claims data for 2017 revealed it gave £60m back to customers over the year through health benefits such as discounted health screens, gym memberships and rewards such as activity devices, coffees and cinema tickets.

Broadly speaking, I like VitalityLife as an insurance offering. In fact I even use the product myself. You can read my detailed Vitality review to find out more detail about the product range, the freebies, and why I think it is a great product (for the right people) which is incredibly cost-effective and can even save you more than it costs.

In June, Vitality unveiled VitalityInvest, its first investment offering. Its suite of three investment products is made up of a Stocks & Shares ISA, a Junior ISA, and a Retirement Plan. The Retirement Plan lets customers save for retirement and draw down their savings once they reach retirement age. Investors can choose from two Vitality fund ranges: an active fund range and a multi-asset risk-targeted range of index trackers with a choice of focus on income or growth. They can also choose from a range of third-party funds to invest in.

The new VitalityInvest products are currently only available through a financial adviser. Vitality says it has created cashflow modelling tools and a personalised life expectancy calculator which advisers can use to show clients how health and lifestyle factors affect their life expectancy and financial planning. The limited distribution channel is understandable, especially as Stocks and Shares ISAs are regulated investment products. However, it will be interesting to see whether, in time, Vitality offer their investment proposition directly to the public.

How does VitalityInvest work?

Vitality says it wanted to create an investment product that addresses the fact that people today are living much longer but are not saving enough to fund their later years, and may also be in poor health. VitalityInvest is aiming to help close the savings gap by linking ‘wellness’ to investments, encouraging long-term behaviour change.

There are three strands to the products’ incentive scheme: Investment Booster, Retirement Booster, and Healthy Living Discount. Here’s a quick run-down on how each of these elements work:

- Investment Booster tops up customers’ savings when they start saving earlier and put away more cash. They can get up to 15% extra on their savings over 25 years. The boost is applied to savers’ money held in Vitality funds, over and above any investment returns.

- Retirement Booster aims to prevent retirees from spending too much of their pot too quickly meaning they then struggle to fund the later years of their retirement. The idea is to encourage them to better manage their income in drawdown, so they get annual boosts to their pot of up to 50% of income drawn. The lower the income drawn and the higher the amount still invested in Vitality funds, the more customers get.

- Healthy Living Discount rewards customers for taking part in Vitality's Healthy Living programme by reducing the monthly product charge on its funds to as little as zero. The Healthy Living programme lets customers move from Bronze to Silver, Gold and Platinum status by taking certain actions to look after their health, such as tracking their daily activity, taking more steps each day, or doing an online health review.

At first glance, I think Vitality should be applauded for their innovation and trying to resolve a number of issues that blight consumers' retirement and investment planning. The three benefits listed above could go some way to helping consumers invest more, pay less in charges and manage retirement withdrawals strategically - all of which are important aspects of good financial planning. But nothing is ever perfect especially when you look at the caveats involved as I do now:

VitalityInvest Investment Booster in more detail

The Investment Booster requires you to invest in VitalityInvest's own funds. Of course, that is understandable as the bonus they pay will at least be partially funded by profits they have made from charging you an annual management fee over a number of years. You only receive an investment boost if you have invested in Vitality funds continuously for five years whether via a Stocks and Shares ISA, Junior ISA or Retirement Plan. As long as you stay invested in Vitality funds then every five years, Vitality will give you another boost. Crucially, your Vitality status (i.e whether you live a healthier lifestyle) has no bearing on this investment boost. The table below shows how the boost can add up over time. However, the most important thing to remember is that the boost is paid in addition to any growth. While the boost is guaranteed, obviously the growth of the underlying funds you invest in is not. So unless the Vitality funds available offer decent returns (versus their non-Vitality peers) you could still theoretically be worse off, despite receiving a bonus. Later in this article, I look at the performance of Vitality funds in more detail and whether the bonus actually represents a good deal.

| Investment Term | Boost | Cumulative boost |

|---|---|---|

| 5 years | 2% | 2% |

| 10 years | 2.5% | 4.5% |

| 15 years | 3% | 7.7% |

| 20 years | 3.5% | 11.5% |

| 25 years | 4% | 15.9% |

| Every 5 years after 25 years | 4% | n/a |

The Healthy Living Discount rewards - how it works?

In order to benefit from the VitalityLife Healthy Living Discount you have to already have a VitalityLife life insurance policy or a VitalityHealth insurance policy. You can read my full Vitality review of these products and why they are worth considering. It is a slight sticking point but emphasises why Vitality Invest is most suited to those people already with a Vitality life insurance or health insurance plan who already earn Vitality rewards. The higher your Vitality status, the more you save on product charges when you invest in Vitality funds. Achieve Platinum status, and you could pay £0. Again the incentive is to encourage you to invest in Vitality funds.

| Value of investment across all VitalityInvest products | If you have a qualifying VitalityLife or VitalityHealth policy and money invested in Vitality funds | For money invested in non-Vitality funds | |||

|---|---|---|---|---|---|

| Bronze status | Silver status | Gold status | Platinum status | ||

| Up to £30k | 0.50% | 0.40% | 0.25% | 0.00% | 0.50% |

| Amount over 30k up to 75k | 0.40% | 0.30% | 0.20% | 0.00% | 0.40% |

| Amount over £75k up to £250k | 0.30% | 0.25% | 0.15% | 0.00% | 0.30% |

| Amount over £250k up to £500k | 0.20% | 0.15% | 0.10% | 0.00% | 0.20% |

| Amount over £500k | 0.15% | 0.10% | 0.05% | 0.00% | 0.15% |

VitalityInvest Retirement Booster - how does it work?

The Retirement Booster is designed to deter retirees from spending too much of their pension pot too quickly so they don't struggle to fund the later years of their retirement. You can only benefit from the Retirement Booster if you have a qualifying Vitality life insurance or health insurance plan or you add Vitality Plus to your VitalityInvest Retirement Plan for an additional monthly fee of £3.80. That's because the retirement boost is based upon your Vitality status (i.e. how healthy your lifestyle is such as going to the gym etc.). Once again you have to have your money in Vitality funds (again incentivising you to invest in their funds). The way the bonus works is to give back a percentage of the amount you have withdrawn from your pension as a lump sum payment based upon your Vitality status, the amount you've withdrawn and the amount you have invested in Vitality funds. The first table below shows the percentage retirement boost you'd receive.

| How much income you withdrew in a year | Retirement booster percentage | |||

|---|---|---|---|---|

| Bronze status | Silver status | Gold status | Platinum status | |

| 0% - 1% | 10% | 20% | 40% | 50% |

| 1% - 2% | 7.5% | 15% | 25% | 35% |

| 2% - 3% | 6% | 12.5% | 15% | 20% |

| 3% - 4% | 4% | 7.5% | 12.5% | 15% |

| 4% - 5% | 0% | 5% | 10% | 12.5% |

| 5% - 6% | 0% | 2.5% | 5% | 7.5% |

| 6% - 7% | 0% | 0% | 2.5% | 5% |

| 7% - 8% | 0% | 0% | 0% | 2.5% |

| 8%+ | 0% | 0% | 0% | 0% |

However, to give this some perspective let's assume you have 85% of your pension in Vitality funds and you had £100,000 in your retirement plan in total (and you had a Vitality life insurance policy) the table below shows you how much you get back in pounds and pence each year. This part of the policy becomes particularly intersting when you attain Platinum status. It is worth pointing out that as you get older it is likely to be more difficult to attain as many active Vitality points through exercise as you did previously. That's just nature taking its toll.

| How much income you withdrew in a year | Retirement booster £ | |||

| Bronze status | Silver status | Gold status | Platinum status | |

| £500.00 | £42.50 | £85.00 | £170.00 | £212.50 |

| £1,500.00 | £95.63 | £191.25 | £318.75 | £446.25 |

| £2,500.00 | £127.50 | £265.63 | £318.75 | £425.00 |

| £3,500.00 | £119.00 | £223.13 | £371.88 | £446.25 |

| £4,500.00 | £- | £191.25 | £382.50 | £478.13 |

| £5,500.00 | £- | £116.88 | £233.75 | £350.63 |

| £6,500.00 | £- | £- | £138.13 | £276.25 |

| £7,500.00 | £- | £- | £- | £159.38 |

| £8,500.00 | £- | £- | £- | £- |

What investments can you buy using VitalityInvest?

Vitality incentivises you to invest in its own funds, so you can only get the discounts and boosters on its investment products (no surprise there). But it does also offer the choice of around 250 funds from third parties, including popular funds from 20 leading fund managers including Aberdeen, First State, Fidelity Invesco Perpetual, Jupiter, M&G and Schroders.

There are two VitalityInvest fund ranges (the ones you need to invest in to get the bonuses): the Performer range of 10 high conviction active funds, managed by Investec Asset Management, and the Risk Optimiser range of five multi-asset risk targeted funds. Performer offers seven growth funds and three income funds, including multi-asset funds, UK and global equity funds, and an absolute return bond fund. Risk Optimiser offers five funds which use Vanguard index trackers to gain exposure to each asset class. The asset mix in each fund is designed by their Dynamic Planner to suit different risk profiles, with risk levels from three to seven (on a scale of one to 10) to choose from.

How much does it cost to invest via VitalityInvest?

When you invest through VitalityInvest there are three charges to pay

- The ongoing fund management charge (the OCF)

- The product charge

- An annual fee to the adviser who advised you to buy a Vitalityinvest product

The ongoing charge figures (OCFs) for VitalityInvest’s actively managed Performer range are between 0.88% and 1.03% a year. The index tracking Risk Optimiser funds have an AMC and OCF of 0.4% a year. The charges for non-Vitality funds vary and are defined by the individual fund managers. As an example, the passive Vanguard US Equity index fund is priced at just 0.10%, while Schroder Small Cap Discovery is 0.98%. The OCF includes Vitality’s investment management and fund administration charges and any third party charges, but excludes transaction costs (the cost of buying or selling assets within a fund).

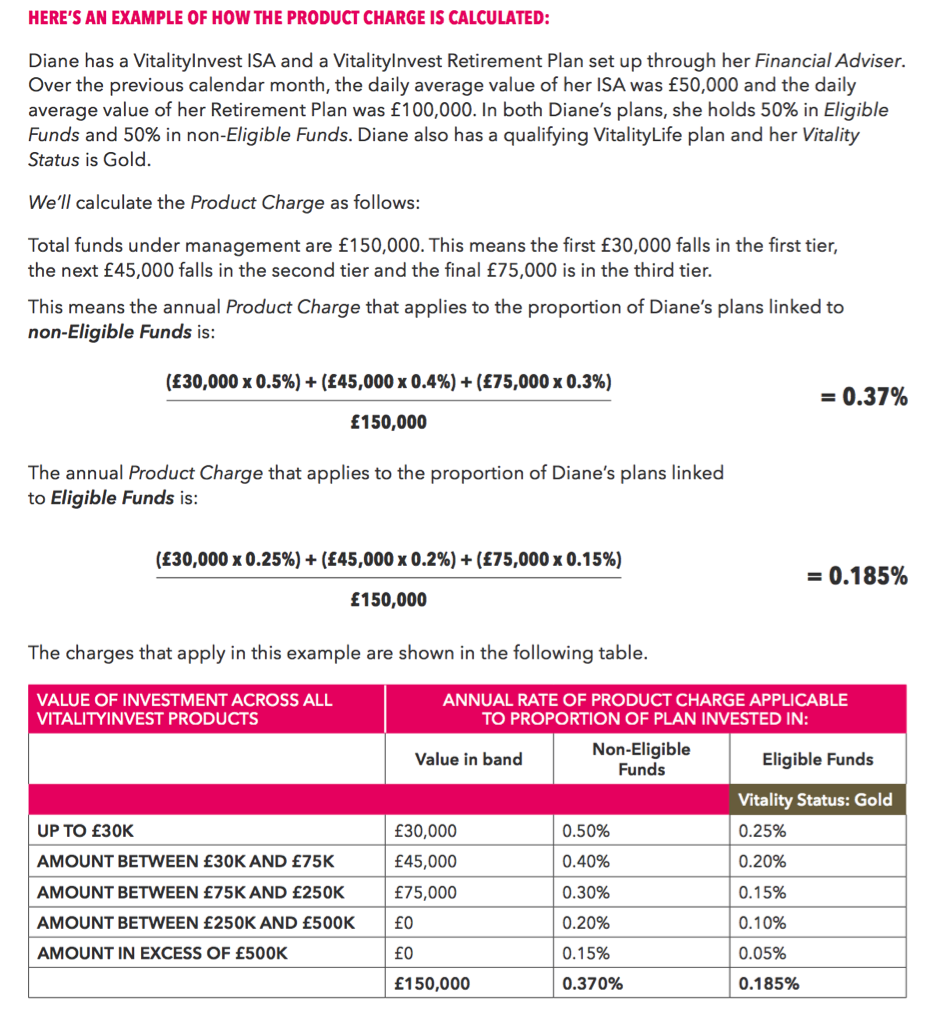

There will also be product charge to pay, and these are quite complex to calculate. The company operates a tiered system, with product charges calculated according to the size of your investment pot, your Vitality status (meaning whether you are classed as a Bronze, Silver, Gold or Platinum customer) and how much of your money is invested in eligible versus non-eligible funds. For example, if you had less than £30,000 in VitalityInvest products, your annual product charge would be 0.5%, falling to 0.4% if you had £30,000 to £75,000, and so on down to the lowest rate of 0.15% if you had over £500,000 invested.

Vitality has come up with an example to show how the charges might work for an individual customer (click the image to enlarge):

So this means Diane is paying a total of £416.28 in product charges each year across her whole portfolio. And, as she would need to buy these products through her financial adviser, she would also be paying an initial or ongoing adviser charge out of her investment plan, plus the fund charges on top. That soon stacks up.

How does VitalityInvest costs compare to other investment solutions?

So although the group trumpets the discounts customers could earn through its incentive scheme, overall the fees you could be paying look quite high, especially if you invested in the passive Risk Optimiser funds. If you bought a FTSE 100 index tracker direct from Vanguard through their Vanguard Investor platform (although they don't yet offer a pension product), you’d be paying an OCF of 0.06%, compared to 0.4% in Vitality’s Risk Optimiser fund.

Or you could go the robo-adviser route and buy a balanced portfolio of exchange-traded funds from a provider like WealthSimple, Wealthify or Nutmeg. Nutmeg, for example, charges you 0.25% on a fixed allocation, risk-rated portfolio above £100,000 which gets rebalanced once a year. Diane’s £150,000 portfolio would cost her an estimated £11 a week in fees if she invested it with Nutmeg, a total of £528 a year, with nothing else to pay.

Of course, on balance, you might feel the health benefits are worth the cost if your Vitality membership is getting you into the gym every week when you were a couch potato before.

How does VitalityInvest manage my investments?

When it comes to Vitality funds that qualify you for all the above rewards and incentives they fall into the Performer range and the Risk Optimiser range.

Investec Asset Management runs the Performer fund range. The group emphasises that the funds are actively managed and aim to outperform their benchmark.

The Risk Optimiser range is made up of Vanguard index tracker funds and aims to deliver long-term returns through both income and capital growth. Vitality says it closely monitors the funds to make sure they stay in line with their set levels of investment risk, rebalancing as needed. There is not yet any information about the breakdown of the underlying portfolios on the group’s website, although there is performance data available from September 2017.

VitalityInvest performance

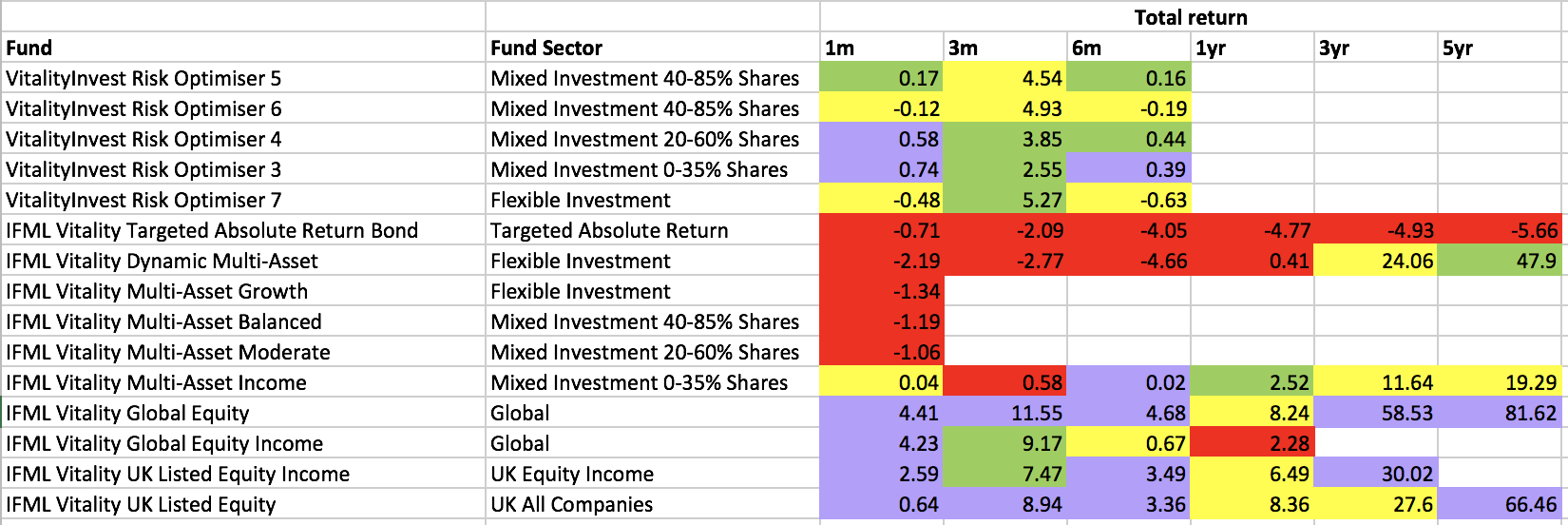

The table below (click to enlarge) shows the performance of the various Vitality funds included within their own range. The table is colour coded to show the performance against each fund's own peer group. Red and yellow shows that the fund has underperformed the market average while purple and green mean that they have outperformed their peer group. As you can see there is some strong performance from the Performer UK equity and global equity funds but others leave a lot to be desired. With regard to the Risk Optimiser funds it is too early to make a judgement but as these are index trackers you would expect them to track the long-term average of the market

Conclusion

Although I like Vitality’s insurance offering for certain people (see my full Vitality review) the investment proposition doesn’t look quite as convincing. On the plus side, the online element is good, as with most Vitality products. However, one of the major downsides is the cost, with passive funds that still look more expensive than some robo-adviser or passive equivalents, even with the various healthy living discounts factored in. You would have to be committed for the long term and pay in a decent sum to get the most out of the fee reductions promised, and there is limited investment choice among the group’s own funds. Yes, you could hold the third party funds instead, but then you would miss out on many of the incentives. Indeed I'm yet to be convinced that, aside from some of Vitality's own equity funds, any incentive or booster from Vitality wouldn't be offset by fund underperformance versus the wider market. The incentive is really there to keep your assets under Vitality's management as that's how they make their money by charging you a percentage fee on your wealth each year. However, there is the very real possibility that investors will hang on to underperforming Vitality funds (if they underperform) in order to receive the promised bonus. That is not in the investor's interest as there is no guarantee that any boost would negate any underperformance. Investors are almost always better off reviewing their funds and making necessary changes rather than simply buying and holding funds indefinitely.

Another issue is that VitalityInvest is currently only available through financial advisers. Given the complexity of the VitalityInvest offering, especially its charging structure, advisers might not be too keen to recommend it to clients. With disclosure rules under MiFID II now stricter than ever, a complicated product like this could entail an administrative and cost burden which could be off-putting to some IFAs. On the other hand, I could see advisers keen to recommend a product that encourages positive consumer behaviour. From a compliance and complaints perspective encouraging people to save more and to sensibly manage their withdrawal strategy can only be a good thing. Only time will tell how the adviser community will respond.

The product is complex to understand which will put some off. Ultimately VitalityInvest would probably be attractive to someone who already holds the group’s insurance products. They would need to be happy to stay with Vitality over the long term to reap the benefits of the various incentives and discounts which may take time to build up. If you’re a health nut or a gym bunny and you’re happy to wear a fitness tracker to get a better deal on your investment portfolio, by all means look at VitalityInvest as an option. Where VitalityInvest could become interesting is if they marketed it directly to consumers cutting out the need to pay adviser charges (so reducing the overall cost). Or maybe one-day Vitality will offer discounted access to third-party offerings such as the robo-advisers mentioned.

If you are interested in finding out more about VitalityInvest and whether it is suitable for you then you can find a reputable financial adviser via a site such as Vouchedfor.