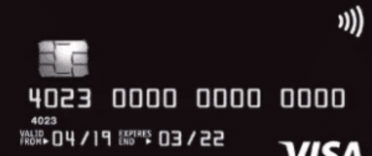

In this article, we are reviewing the MBNA 0% Transfer and Purchase credit card, which stands out for its long interest-free periods on balance transfers and purchases.

In this article, we are reviewing the MBNA 0% Transfer and Purchase credit card, which stands out for its long interest-free periods on balance transfers and purchases.

Key facts about MBNA 0% Transfer and Purchase credit card

-

Best for: Those looking for a multipurpose card with a long interest-free period on balance transfers and purchases

-

Introductory offer: Up to 22-month interest-free period on balance transfers and 22 months on purchases (only purchases made in the first 60 days will be interest-free).

-

Representative APR: 24.9%

-

Fees: 3.49% balance transfer fee

- Perks: Earn cashback with select retailers through MBNA Smart Rewards.

Pros of MBNA 0% Transfer and Purchase credit card

- Its interest-free periods stack up well against its rivals

- Potential to earn cashback through spending at select retailers

- Although MBNA is part of Lloyds Banking Group – alongside Lloyds Bank and Halifax – balance transfers from those providers are accepted to this MBNA card

Cons of MBNA 0% Transfer and Purchase credit card

- The transfer fees can be high, especially when there are fee-free options available, albeit often with less favourable terms on the length of the introductory offer

- After the first 60 days, any purchases, balance transfers or money transfers won't be interest-free

- You may not be offered the full 22-month interest-free period on purchases or balance transfers

How to manage your payments on MBNA 0% Transfer and Purchase credit card

MBNA has online and mobile accounts, so you are able to manage your card easily.

How to find out which credit card is best for you

You can use Money to the Masses partner Creditec* to quickly build a list of the credit cards that match up with your needs. By simply adding in a few basic details, you will get a tailored collection of the best credit cards for you. You can use your Creditec results to check how likely you are to be accepted for a certain card, which cards available to you offer the best rewards or find out what option will leave you with the lowest fees to pay. Creditec is able to check your eligibility without running a full credit check, which means your credit score will not be affected. Click this link to start your comparison*.

How to apply for the MBNA 0% Transfer and Purchase credit card

MBNA has a 'Clever Check' system, which assesses applicants' eligibility for its whole range of cards, as well as the potential credit limit, without leaving a hard footprint on your credit file.

Alternatives to the MBNA 0% Transfer and Purchase credit card

- Capital One Balance Transfer credit card

- M&S Shopping Plus Offer credit card

- Santander All in One credit card

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product.