Who is Wealthify?

Who is Wealthify?

Wealthify* is a UK based independent robo-advisor which invests in ETFs to keep clients' investment management costs to a minimum. Similar to other robo-advisers (such as Nutmeg and Moneyfarm). Wealthify uses an automated process to create portfolios that align with a client's appetite for risk.

In October 2017 Aviva, one of the largest insurance companies in the UK, acquired a majority stake in Wealthify and on 5th June 2020 Wealthify became a wholly-owned subsidiary of the Aviva group, however, it will continue to be individually run. It is yet another example of an established financial institution acknowledging that robo-advice firms like Wealthify represent the future of investing in the UK. The biggest challenges facing robo-advice firms are gaining funding (from financial investors) and client acquisition. As they charge their clients such low fees their profit margins are very slim so they need to acquire large numbers of customers in order to become profitable. The arrival of Aviva should soothe that headache for Wealthify as it can now be promoted to Aviva's extensive client database.

1 minute summary - Wealthify Review

- Invest from as little as £1 (£50 for Pensions)

- No management fees for 12 months – Invest in a Wealthify Stocks and Shares ISA*, Junior ISA*, SIPP* or General Investment Account* and pay no management fees for 12 months. New customers only. Terms and conditions apply, capital at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future. Leadenhall Learning Limited (trading as Money to the Masses) is an appointed representative of Wealthify Limited which is authorised and regulated by the Financial Conduct Authority. Money to the Masses acts as an appointed representative for the purpose of promoting Wealthify products and introducing customers to Wealthify.

- Simple annual flat management fee of 0.60% irrespective of how much you invest

- Ethical investment options

- Build a sample portfolio* and see your projected value in a few simple clicks. As with all investing, your money is at risk. The value of your portfolio can go down as well as up and you could get back less than you put in

Because Wealthify investments are likely to be of interest to some readers, we have highlighted an offer for Money to the Masses readers.

Wealthify ISA, Junior ISA, SIPP or General Investment Account Offer

Open a Stocks and Shares ISA*, Junior ISA*, SIPP* or General Investment Account* and pay no management fees for 12 months. Cannot be used in conjunction with any other offer. New customers only. Terms and conditions apply. Capital at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

How does Wealthify work?

Wealthify has a team of investment experts who have developed an investment process that uses algorithms to select the best funds and create an investment plan that suits the client's attitude to risk. The Wealthify investment team then continuously monitor and adjust a client's portfolio to maintain their investments in line with their attitude to risk. Clients can keep track of their investments online on PC, tablet or phone via the Wealthify app and can add or withdraw money with just a few clicks. So far so good.

Wealthify application process

An investment can be made with a minimum of £1 (except Wealthify's SIPP which requires a minimum investment of £50) and additional investments can be made at any time. This minimum investment level sets Wealthify apart from the likes of Nutmeg and Moneyfarm, both of which require a minimum investment contribution of £500. Scalable Capital, on the other hand, requires a minimum contribution of £10,000.

Customers are accepted over the age of 18

Low minimum investment of £1 (£50 for Wealthify's SIPP)

No charges for opening or closing accounts so you could move to another service if you become unhappy in the future.

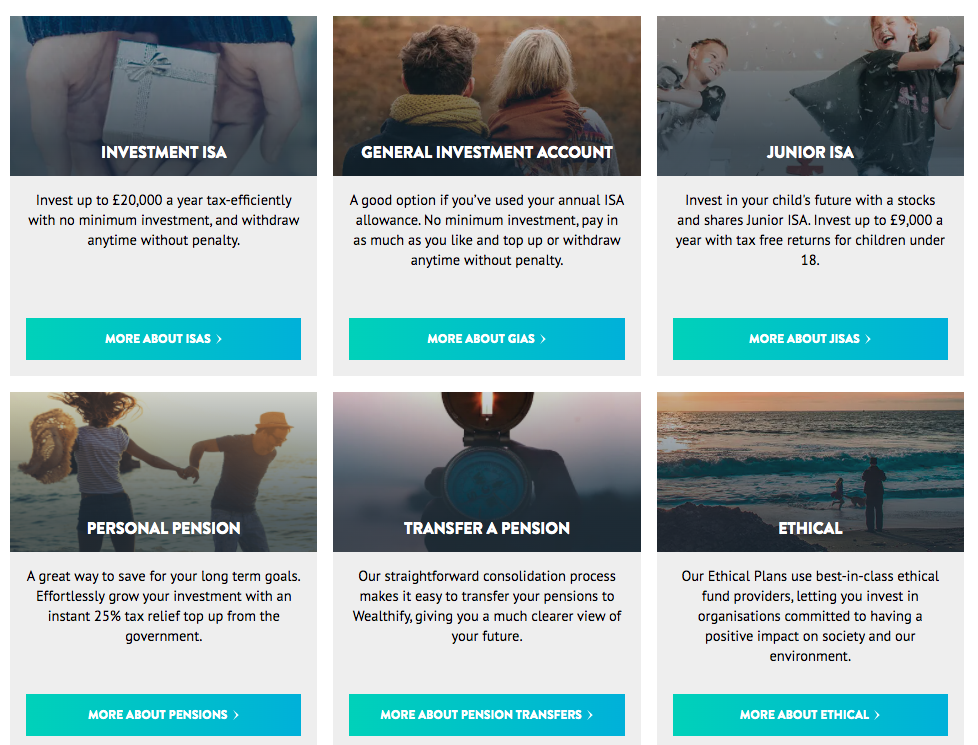

When you open an account you first have to choose between a Wealthify Stocks and Shares investment ISA, general investment account, a Wealthify Junior Stocks and Shares ISA or a Wealthify Pension. You will be given the option of whether you want to invest ethically in any of the four options by selecting ‘Ethical investments'.

If you have not used your annual ISA allowance then you may want to consider investing via one of Wealthify ISAs as any income or capital gains will be tax free. I chose a Stocks and Shares ISA.

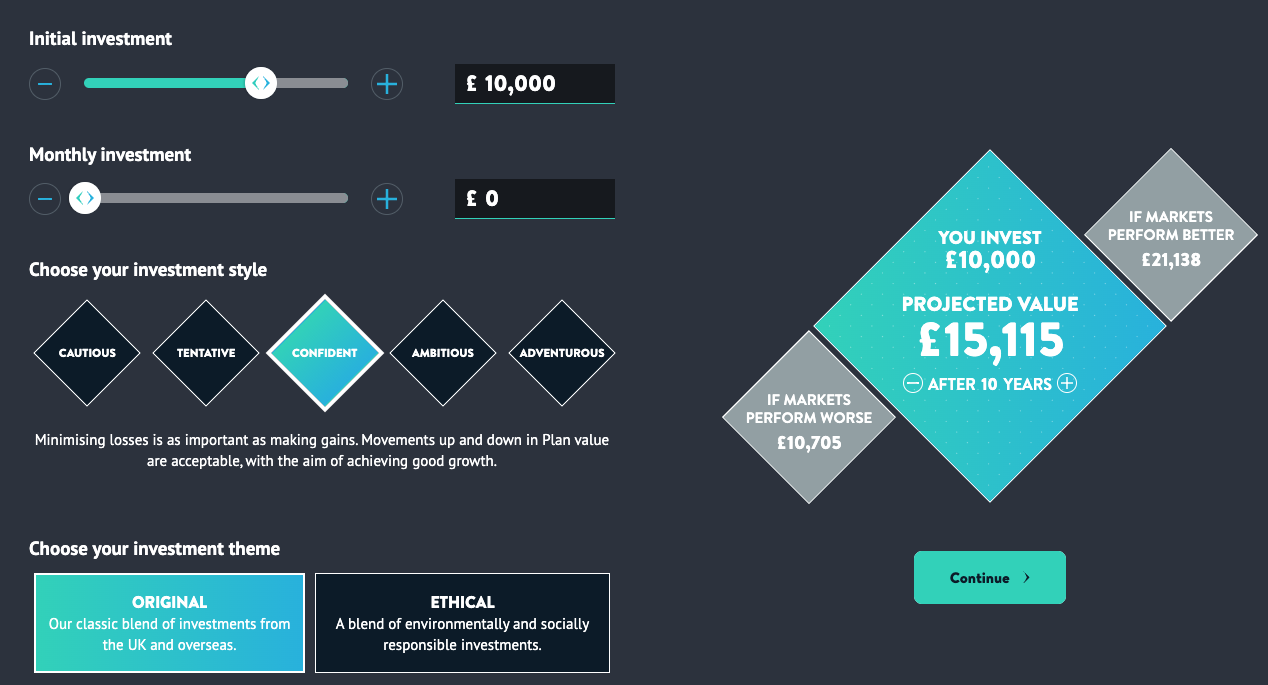

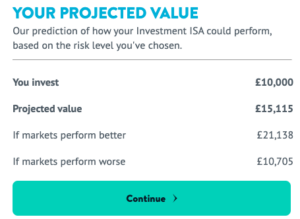

Now, usually with most robo-advisers they first require you to complete a risk profiling questionnaire of some kind before providing a sample portfolio. In this regard Wealthify is much slicker than many of its peers as you get straight into building an investment portfolio, with further risk profiling questions coming later in the process. Once you've chosen the plan type you want (i.e an ISA) you are presented with a ‘Create Your Plan' page as shown below (click to enlarge the image). The user interface of this page is very good with the use of scroll-bars to set your investment amount, how long you want to invest for and the level of investment risk you are happy to take. You are then presented with a projected value for your investment by the end of your stated investment term, but of course this is not guaranteed.

Projected value as of 26.01.24

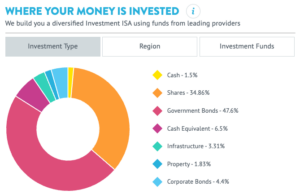

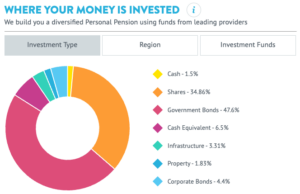

You can then choose to see how your plan will be invested and you will be presented with a portfolio like the one below which shows you the types of assets Wealthify would invest in on your behalf (click to enlarge).

You can see from the screenshot that I went for a ‘confident' investment style, or in other words Wealthify's medium risk portfolio. It is fairly cautious with around 60% of the assets in low-risk investments such as cash and bonds while 34.86% is invested in equities.

To produce your own Wealthify portfolio as I have it will only take a couple of minutes which is quicker than other robo-advice propositions. So I suggest that you take a few minutes to see the Wealthify* portfolio that would suit your attitude to risk. It's free to do so with no obligation on your part. Once you've done that you can also alter the portfolio risk level to see how it impacts the asset mix, which is a useful exercise. Once you have been presented with a portfolio you are then invited to begin setting up a plan, which in the first instance means going through a multiple-choice questionnaire to see if investing is suitable for you, as shown in the image below. The questions seek to understand:

- Your investing experience

- Your attitude to risk

- Your finances

Depending on your answers you can in fact be rejected by Wealthify on the basis that investing is not suitable for you, if for example you have no savings and high levels of debt. This is kudos to Wealthify as investing isn't for everyone and shows that it is living up to its moral and legislative obligations. Assuming that you pass through the screening process you can then fund your investment online.

What products does Wealthify offer?

As well as a general investment account, Wealthify offers a Stocks and Shares ISA* and a Junior Stocks and Shares ISA* which, along with the minimum investment of £1, makes an ideal starting point for new investors. Wealthify has joined the likes of robo advisers Nutmeg and Moneyfarm in launching a Self Invested Personal Pension (SIPP). Those interested in Wealthify's Pension will need to start with a minimum investment of £50.

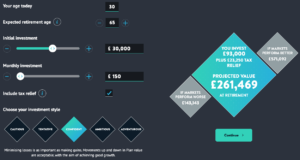

Wealthify pension

Wealthify's pension* is relatively easy to set up. Once selected, you'll be presented with a set of questions and scroll bars and you'll need to choose your expected retirement age, initial and monthly investments and investment style. You'll then be presented with a projected value for your investment at retirement (which again is not guaranteed).

Projected value as of 26.01.24

You can then choose to see how your pension will be invested including the types of assets, the regions as well as the actual funds that it will invest in.

Once happy, you'll be encouraged to open an account. You'll pay an annual flat fee of 0.60% irrespective of how much you invest and you'll pay average fund fees of around 0.16% or 0.70% if investing ethically. If Wealthify's pension* interests you then you may also wish to take a look at the pensions on offer from Nutmeg and Moneyfarm – just click on the links to find out more.

What is Wealthify's investment strategy?

Wealthify invests mainly in passive investment funds such as Exchange Traded Funds (ETFs) and Mutual Funds. The mix of funds in a client portfolio will depend on their attitude to risk and is monitored constantly to ensure the mix of funds still reflects the client's investment goals and the portfolio they selected during the account opening process.

How does Wealthify manage its portfolios?

Wealthify manages portfolios with a mixture of automated and manual systems to create and monitor client's portfolios. Global markets are constantly monitored using computer-based algorithms which is a cost-effective strategy allowing clients to invest with lower fees. In addition to the automated process, Wealthify experts use their knowledge and experience to make adjustments to client portfolios where appropriate. In this regard they are just like many of the other robo-advice services such as Nutmeg and Moneyfarm.

What are Wealthify's fees?

Wealthify* charges a simple annual flat fee of 0.60%, irrespective of how much you are investing. The new fees mean that of all the robo-advisors, Wealthify offers the cheapest managed portfolio with £20,000 or less invested.

The chart below compares Wealthify fees vs Nutmeg fees v Moneyfarm fees

| Investment amount | Wealthify portfolio fee | Nutmeg managed portfolio fee | Moneyfarm portfolio fee |

| £0 – £10,000 | 0.60%¹ | 0.75%² | 0.75%³ |

| £10,001 – £20,000 | 0.60% | 0.75% | 0.70% |

| £20,001 – £50,000 | 0.60% | 0.75% | 0.65% |

| £50,001 – £100,000 | 0.60% | 0.75% | 0.60% |

| £100,001 – £250,000 | 0.60% | 0.35% | 0.45% |

| £250,001 – £500,000 | 0.60% | 0.35% | 0.40% |

| over £500,000 | 0.60% | 0.35% | 0.35% |

¹Wealthify will waive its management charges for 12 months for Stocks and Shares ISA, Junior ISA, SIPP and general investment account applications. Check out our Wealthify offers to find out more. New customers only. Terms and conditions apply. Capital at risk.

²Nutmeg will waive its management charges for the first 12 months. Check out our Nutmeg review to find out more.

³Moneyfarm will waive its management fees for up to 12 months. Check out our Moneyfarm review to find out more.

As the table above shows, Wealthify is very competitive for those with less than £100,000 to invest but not so for those with more than £100,000. In addition to the Wealthify fees stated above there is an average fund charge of 0.16% which is typical for a robo-advice firm. Those wishing to invest ethically will pay an average fund charge of around 0.70% which is actually a little expensive when compared to the likes of Nutmeg (0.35%) and Moneyfarm (0.21%).

Wealthify has a ‘refer-a-friend' scheme that rewards customers with £50 for every friend they refer, as well as £50 for the friend. Terms and conditions apply.

Wealthify performance

When a Wealthify account is opened a ‘predicted value' figure is provided which indicates the potential value of a client's investment over a period selected by the client. This is not a guarantee and I'd argue that it is of limited use.

Wealthify has 5 investment plans (Cautious, Tentative, Confident, Ambitious & Adventurous) whose performance is monitored regularly against industry benchmarks.

Below we have summarised Wealthify's 2019, 2020, 2021, 2022 and 2023 performance data for its original portfolios as well as its ethical portfolios

Wealthify Performance – Original Portfolios 2019 to 2023

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Cautious | 6.40% | 2.70% | 0.50% | -11.20% | 4.70% |

| Tentative | 9.40% | 3.90% | 3.70% | -10.80% | 6.20% |

| Confident | 11.90% | 4.90% | 6.70% | -10.30% | 7.80% |

| Ambitious | 14.40% | 5.10% | 9.70% | -9.40% | 9.40% |

| Adventurous | 17.10% | 5.10% | 12.80% | -9.10% | 11.30% |

Wealthify Performance – Ethical Portfolios 2019 to 2023

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Cautious | 7.90% | 4.10% | 0.70% | -14.70% | 4.80% |

| Tentative | 9.70% | 6.50% | 4.10% | -15.40% | 6.80% |

| Confident | 11.80% | 9.00% | 7.60% | -16.30% | 8.80% |

| Ambitious | 14.10% | 11.20% | 11.20% | -17.20% | 11.00% |

| Adventurous | 16.70% | 13.40% | 14.70% | -18.50% | 13.60% |

But more importantly, how does Wealthify's performance compare to other robo-advice firms? As with all investing, past returns are no guarantee of future results. The value of your portfolio can go down as well as up meaning could get back less than you put in.

Wealthify vs MoneyFarm vs Nutmeg performance

The table below shows the Wealthify vs Moneyfarm vs Nutmeg cumulative performance between 2019 and 2023. To produce the comparison below I've compared the comparable Moneyfarm and Nutmeg portfolios with the equivalent Wealthify portfolios. Moneyfarm and Nutmeg offer 7 and 10 portfolios respectively, versus Wealthify's 5.

| Wealthify 5 Year Performance (2019-2023) | Moneyfarm 5 Year Performance (2019-2023) | Nutmeg 5 Year Performance (2019-2023) | |

| Cautious | 0.42% | 1.63% | 2.08% |

| Tentative | 2.23% | 3.15% | 2.78% |

| Confident | 3.90% | 4.40% | 4.77% |

| Ambitious | 5.51% | 5.49% | 6.14% |

| Adventurous | 7.03% | 6.79% | 7.31% |

Based on the data above Wealthify's higher-risk portfolios perform better against the likes of Moneyfarm and Nutmeg. Its lower-risk portfolios have lagged its competitors slightly and this may not be surprising given my observation of Wealthify's generally more cautious portfolio allocation earlier. It is worth mentioning that Wealthify also has a range of 5 ethical portfolios that allow investors to gain exposure to organisations that are committed to having a positive impact on society and the environment. We have summarised the performance of the Wealthify ethical portfolios below.

What other services does Wealthify provide?

Wealthify is not regulated to provide financial advice to their clients but investments up to £85,000 are covered under the Financial Services Compensation Scheme (FSCS).

Wealthify customer reviews

Wealthify is rated as ‘Great' and has a rating of 4.0 out of 5.0 from over 2,300 reviews on independent review site Trustpilot. Below is a sample of reviews published from existing Wealthify customers on Trustpilot:

‘Always available for help by email/phone and that what counts and makes you feel confident in the business and ability to work for their clients' – Chris

‘I'm generally happy with the service I've received, but I can't comment on the investment performance as I've only had my ISA for 6 months' – Mike

‘Very happy with the service and the easy of keeping up to date with everything, would definitely recommend to any friends or family' – Jackie

‘Excellent company and investment service that makes me comfortable parting with my money. Wealthify is the future with its roboinvesting platform' – Paul

‘Great website. brilliant customer service-respond quickly to any concerns. Fees are fair and transparent' – Pete

Conclusion

- Wealthify* provides a value for money, hassle-free passive method of investing in the stock market and is ideal for beginners given that you can start investing with as little as £1 (£50 for pensions).

- Invest in a Wealthify Stocks and Shares ISA*, Junior ISA*, SIPP* or General Investment Account* and pay no management fees for 12 months. New customers only. Terms and conditions apply, capital at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

- Its charges are very competitive, but less so for larger investors (those with over £100k to invest) due to its annual flat fee structure. Wealthify offers the cheapest managed portfolio with £20,000 or less invested assuming you aren't using any of the promotional offers elsewhere.

- It's worth bearing in mind that there is no reason to not invest with more than one robo-adviser, to stop you having all your eggs in one basket (although you can only open one Stocks and Shares ISA each tax year).

- Wealthify or any other robo-advice service for that matter won't suit those wanting to be more involved in how and where their money is invested. If you want to take a more hands-on investment approach which empowers you to run your own money and make your own fund decisions then have a look at my 80-20 Investor service.

If a link has an * beside it this means that it is an affiliated link. If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any offers – Wealthify, Moneyfarm